Alpha Bits - 9.16.22

Here is a quick post on some interesting projects that could be worth following / researching (including an airdrop) + other general alpha. Please note that the next paid deep dive will be coming early next week + chainEDGE is finally nearing its initial launch by the end of October, so be on the lookout for that.

Potential Airdrop - Shell Protocol:

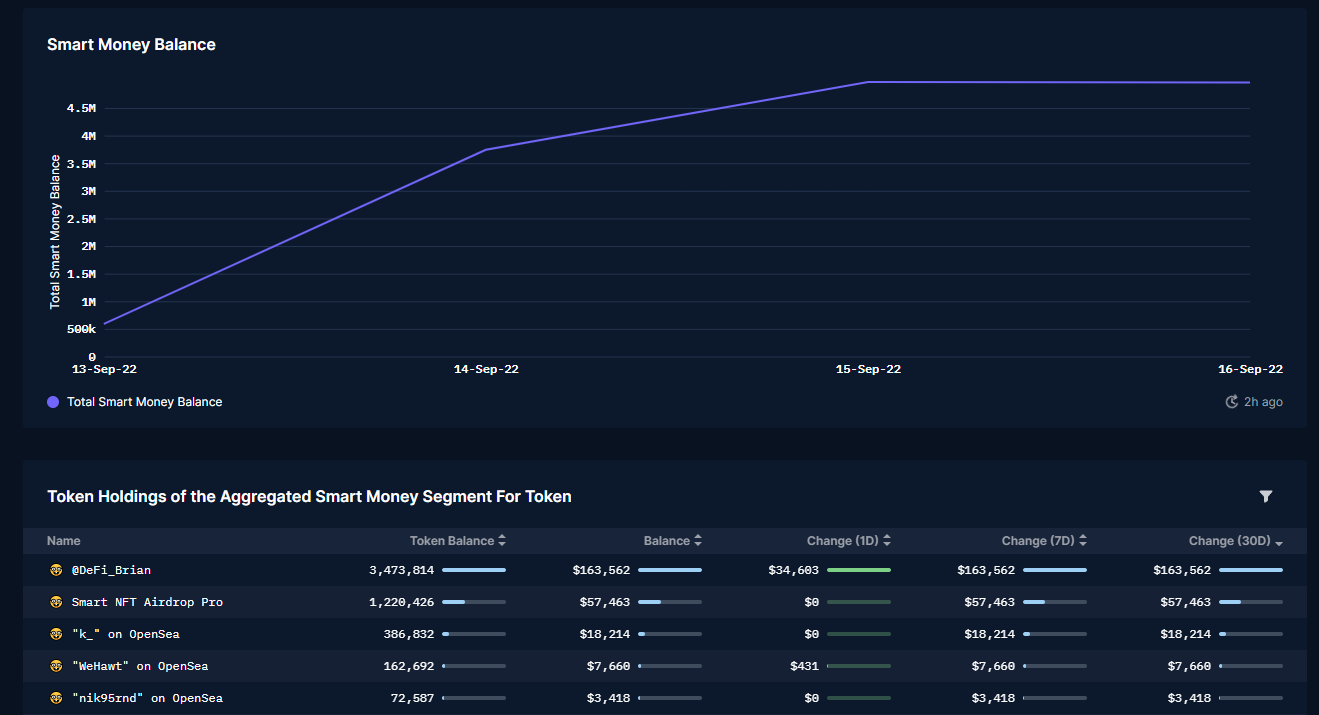

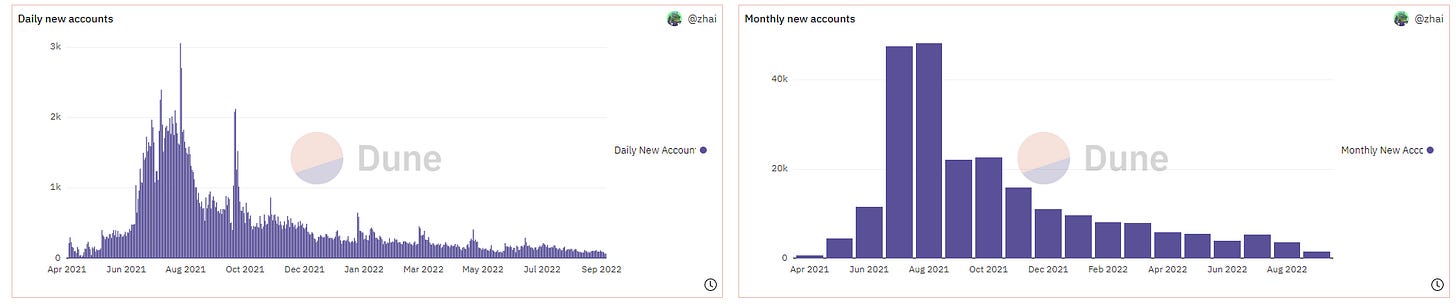

I’ve been seeing some smart money deposit into this project on Arbitrum, to the tune of ~$462k in the past week. Given there is no token for Shell yet, they are likely positioning themselves for a potential airdrop.

The project launched their v2 on Arbitrum back on September 12th + it seems Shell has built a new AMM structure that aims to significantly reduce gas costs. A lot of the smart money that has deposited into the protocol are “Airdrop Pros” - while the team has not confirmed any airdrop/token, could be worth depositing/interacting a small amount with the project (you can deposit stables). No guarantee that an airdrop actually happens, but seeing the smart money flow in is always an encouraging sign.

Degen GLP Yields on Vesta:

The market has turned cold again, and most yields across the board are way too low to justify the risk of farming/staking. A solid place where people have been parking capital to earn yield is in GMX’s GLP → if you aren’t familiar with GLP, you can read more about it here. Current yields to GLP stakers are ~32%, paid in ETH (from trading fees on the GMX platform).

But if you want to climb up the degen risk curve (please be responsible, know your liquidation risks, and not a recommendation), you can use Vesta on Arbitrum to boost up your GLP yields. You can read more about it here, but basically you can buy GLP, deposit it into Vesta to mint their stablecoin VST and you can loop the debt (similar to Abracadabra), up to ~6x leverage. Vesta is capping the base yield at ~20% (and taking the rest as fees), so you can theoretically amplify your yield (with liquidation risks) to anywhere from 40-120% on what is a pretty stable asset. If you do end up using this strategy, best to keep position sizes small given smart contract, leverage and GLP specific risks.

The GLP levered vault is capped at 3mm VST minted, so keep that in mind if you plan on checking this one out.

Alt Plays & Strategies on Arbitrum:

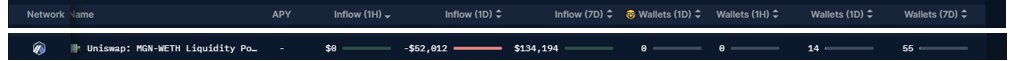

2 other projects seeing activity from smart money on Arbitrum are (1) MGN and (2) Dopex’s Straddles.

Mugen / MGN is a pretty new project on Arbitrum, which is a cross chain yield aggregator using Layer Zero. I think currently they have a GLP strategy, but will be rolling out a host of other strategies. The token has only been around for ~8 days, so very new with few people really knowing about it, so could be an undiscovered gem (as always, do your own research). At a $2.5mm market cap at writing, if they get traction on their strategies (it sounds like they will be launching a Dopex straddle strat, and there is lots of alfa in their discord), it could have plenty of upside.

It is also interesting to note the amount of smart money using Dopex’s Atlantic straddle product, with inflows of ~$536k on the ETH vault and $170k on the DPX vault. With ~3 day epochs, if you think we see extreme volatility around key macro dates, buying these could have very good payoff structures (I think ETH straddle buyers into the Merge are up ~70%+). Alternatively, if you think volatility starts to subside, and the market chops from here, you can deposit and earn premium from the other side of the trade (if you aren’t familiar with options, probably not worth trying this strategy).

Other Interesting Stuff:

Sounds like veYFI launch is very close - a catalyst I wrote about here

Smart money flowing into Sweatcoin:

Despite softening market conditions, smart money into BONE ahead of SHIB’s Shibarium launch has been up only:

Unlocks:

When the market washes out, folks have asked me for upcoming unlocks to look into to either protect capital or look for short opportunities. Some major upcoming ones below (per Token Unlocks):

APE - sounds like APE has a ~3% unlock in a few hours, representing ~$150mm or nearly 10% of the current circulating market cap (APE trades with pretty good liquidity, so may not be that bad of an unlock)

YGG - $6mm unlock coming on 9/27, which is ~13% of the current circulating market cap for the coin - and volume on this one is quite low, so has the potential to be nasty

DyDX - $6.6mm unlock on 10/4, ~8% of current circulating market cap (liquidity better than YGG).

IMX - probably one of the worst near term unlocks, with ~$199mm coming on 10/13 - vs. a $185mm circ market cap. Given trading volumes are a fraction of the unlock size (and the unlock itself is bigger than the circulating supply, this is probably a good one to watch

AXS - $274mm unlock on 10/24 vs. $1bn circulating value and ~$70mm in volume - does not look good, especially given usage has fallen off a cliff.

As always, drop any comments, questions or thoughts below.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

the bit I'm most interested in is the launch of chainEDGE - I really can't afford nansen after the trial

Did some research on SHELL yesterday and You need to hit quota by wrapping coins and buying toucan NFTs (buy them on Stratos AND tofuNFT and it could be a little boon towards the possible Arbitrum airdrop). Once you hit quota you can start earning SHELL Points, and eventually have the option to LP. Once you can LP, it appears, this is how the "airdop pros" were depositing, thus to follow their lead, you need to spend the time with wrapped coins and toucans to even be eligible to LP.