Your quick guide to the Arbitrum airdrop and some data to help you trade it. I have long written about the Arbitrum airdrop and the ensuing ARB SZN, and the day has finally arrived. On Thursday, Arbitrum finally announced the airdrop for the L2 (you can check your potential airdrop here). Claiming and trading of the token will go live in 5 days, so I thought it would be great to go over the situation, including airdrop distribution, ARB tokenomics, potential valuation perspectives, historical airdrop trading case studies and then what Arbitrum ecosystem tokens stand to potentially perform best after the airdrop (based on catalysts and smart money flows). Please note that tomorrow I will be releasing a long awaited deep dive for paid subs (where we hopefully can replicate similar results as our GRAIL deep dive) and next week I’ll do another Smart Money Watching report.

Side note before diving in: I am looking to add someone to our team, which will be a intern/content writing support person. You can email me at onchainwizard@gmail.com with your qualifications, content you have produced, etc. This is kind of a jack of all trades opportunity, where you will help us write content both for the newsletter and for chainEDGE. No hard requirements to get the gig → we are just looking for someone that is highly “keyed in” to the DEX trading ecosystem, and that wants to be a part of what we are building.

Arbitrum Airdrop Overview

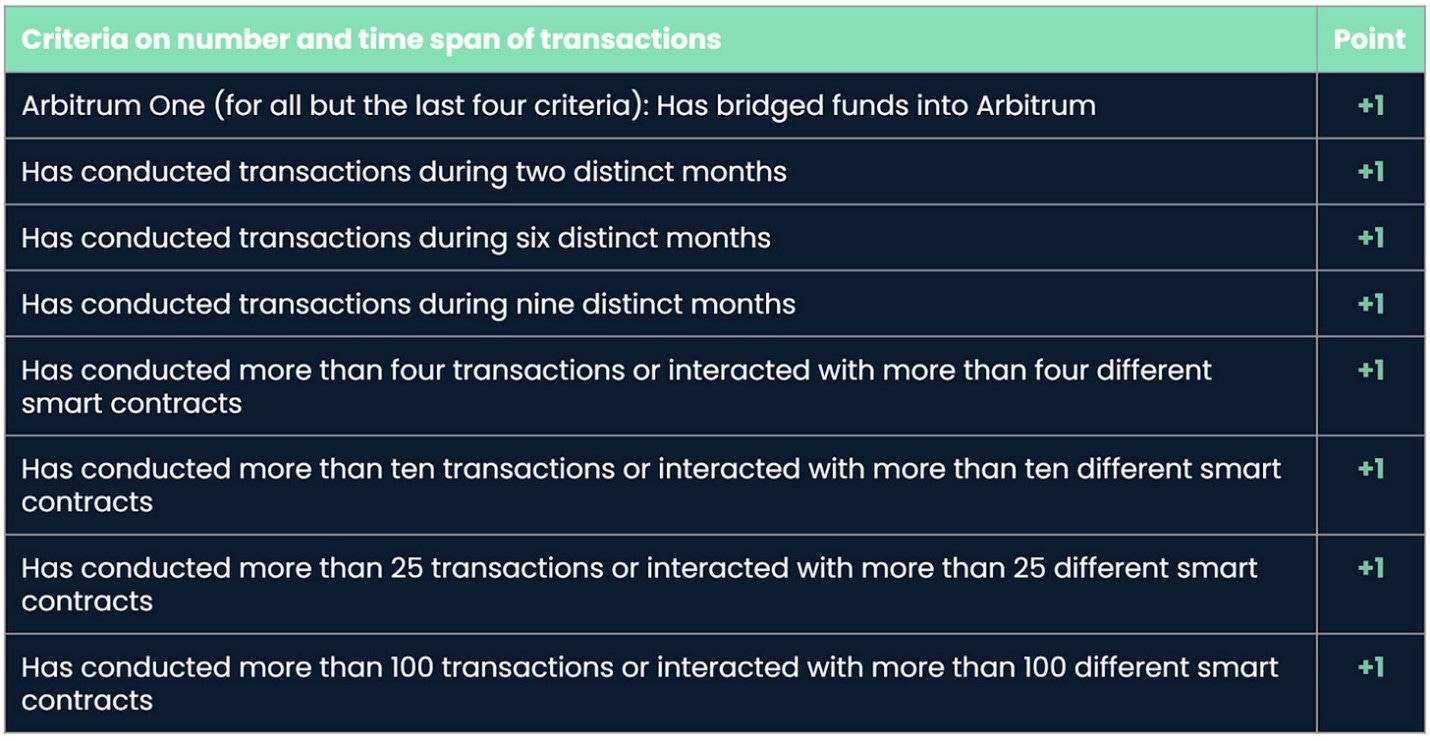

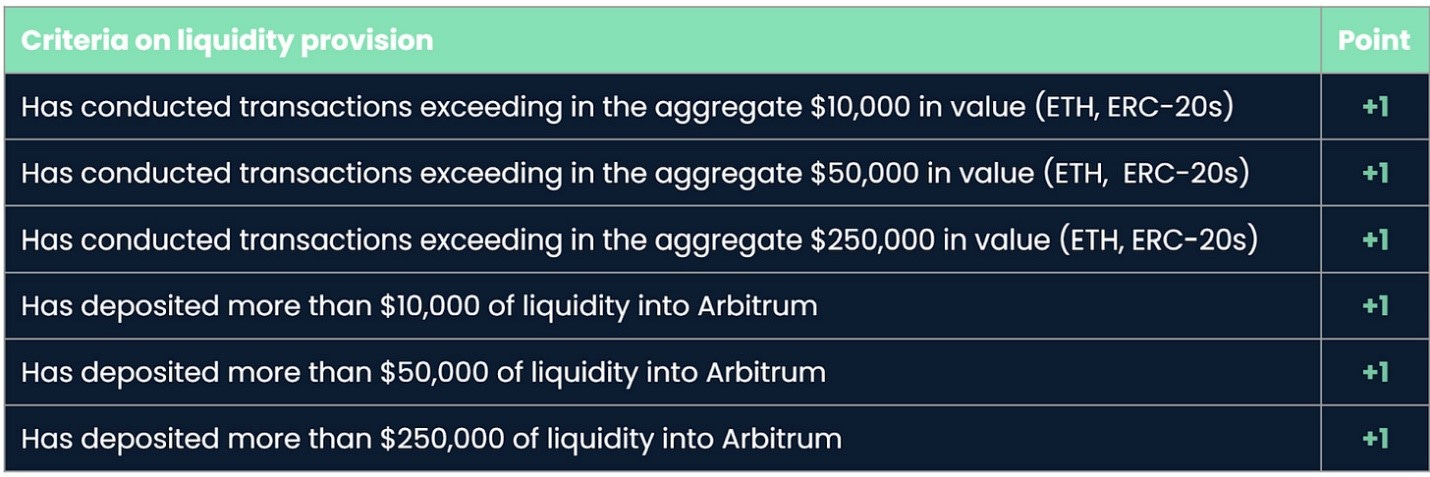

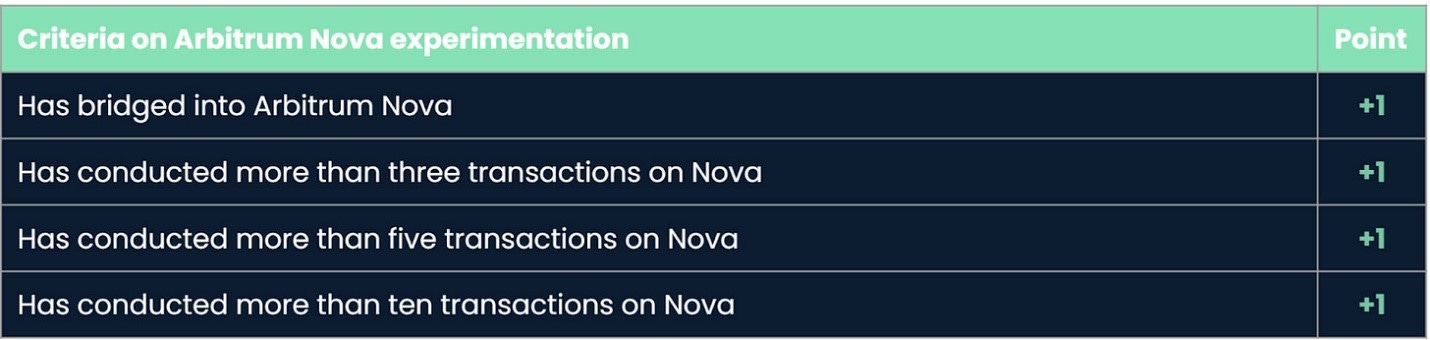

The token will launch and be claimable on Thursday, March 23. So if you see scam ARB tokens already trading, you should obviously avoid them. The snapshot for the airdrop was taken on February 6th of this year. If you are curious about how the eligibility criteria for the airdrop was designed, the below snapshots from Nansen will help. While obviously you can’t attempt to get the airdrop now if you were not eligible, you can take note of these criteria for any other upcoming major airdrops.

There were 625k wallets that ended up getting the airdrop, the distribution of which you can see below. If you had a wallet that received 10,250 ARB tokens, congratulations on being a fellow absolute degen! It is interesting to note that most of the distribution is heavily weighted towards small amounts per wallet. You can check out a good dune dashboard on the airdrop here.

In terms of tokenomics, the total supply of ARB is 10bn tokens, with 1.275bn being airdropped.

The insider allocations for the token are higher than the UNI and OP airdrops, with the treasury, the team and Arbitrum investors owning 87% of the token.

In terms of initial airdrop distribution, ARB is on the higher end vs other major airdrops like OP and 1INCH:

And in terms of emissions, the ARB supply schedule looks pretty good, especially for the first year.

ARB Valuation and Trading

Ok, so you are either wondering how to trade your to be claimed airdrop, or how to trade the token in general. While I have seen BS “IOU” charts showing ARB at $10, in the real world it sounds like OTC pricing is settling around $1.10 currently.

Now most people have done simple TVL vs. FDV calculations to say where Arbitrum should be trading, which usually look something like the below from Artemis.

This analysis has typically used OP as the closest comparable to ARB, given the 2 L2s are the leaders in terms of TVL. The simple valuation methodology folks have been using is OP FDV/TVL is ~5.74, and if you apply this to ARB’s TVL, you get an implied FDV of $22bn or a $2.2 ARB price. Or a $1.18 ARB price if its FDV is equal to OP.

What I find interesting in this analysis is that the primarily input, OP’s TVL, contains ~$800mm of native OP tokens (according to Dune), which is over 1/4th of the chain’s TVL. If you exclude this from the “multiple” calculations, then you would obviously get a much higher implied ARB price → but again this is crypto and valuation methods can be a meme, so don’t take this as gospel.

In terms of transaction counts, active addresses and contracts deployed, ARB is significantly outperforming OP, so at least in my opinion the ARB FDV should shake out higher than OP’s (so at least a price above $1).

Source: Dune

Ok, so we have a rough range of where it could trade (anywhere from $1-2 makes “sense”), but how will the price action of the token be once its claimable? Starting off, its worth looking at this really cool “post airdrop price” analysis from @cptn3mox. While there are some crappier tokens in here, at least for major airdrops, I feel like they always follow a pattern of (1) immediate dumping of claimable tokens, (2) the token pumps, CEX listings come in and people FOMO into the token and then (3) trading normalizes and then token trades off / distributes for a bit.

Using Blur as the most recent (and potentially relevant example), the token traded off sharply and then pumped 150% from the airdrop dumping lows. This happened faster than previous airdrops, but the setup remains the same. From there the token trades down. Now given this is a bigger airdrop ($1.2bn if ARB price is $1), this could change things. If everyone decides to sell, that is a lot of sell-side liquidity to absorb, so you obviously will need to come to your own conclusions. With that said, Arbitrum continues to pick up momentum as a chain, so from a “fundamentals” point of view, things are very strong.

How To Play It

If you are looking to trade ARB or time your airdrop sells, obviously you need to come to your own conclusions (this is not financial advice). But I am going to watch for similar price action to Blur’s airdrop to time when to sell my tokens or even accumulate more. If the price gets cheap enough (anything under $1?), then I think it could be worth investigating a longer term hold position. This is just one way to play it though. Because of the airdrop, the Arbitrum ecosystem will effectively be getting a $1bn stimulus check. While a portion of the funds certainly will be either held long term in ARB or sold to fiat, we can assume some portion of these new found profits will have 2 impact to Arbitrum ecosystem tokens: (1) Some degens will take their airdrop dollars and allocate to the “strongest” Arb tokens, like MAGIC, GRAIL and RDNT. (2) But there is also a secondary effect, which is plenty of the wallets receiving the airdrop are likely particpants that slowed down their trading or took a break from the space. So you will have more dollars and participants sloshing around the ecosystem, where dollars could flow into the best projects on the L2.

So what is the best secondary way to play the airdrop? Well Arbitrum tokens have already performed very well leading into the airdrop announcement and after, so let’s look at which tokens chainEDGE smart money traders are actively buying (7 day net swap flows):

Gridex ($424k)

This is a brand new token that launched on Arbitrum a few days ago. It looks like they built an onchain DEX trading order book. The flows are dominated by a “new launch pro” wallet, and I have not seen much mentioned about this one, so exercise caution

RDNT ($251k)

If you don’t know this one, it is an omnichain money market project with the third highest TVL on Arbitrum. They have an upcoming catalyst (v2 upgrade) worth looking into as well.

VELA ($59k)

Perp DEX on Arbitrum that has performed well since launch. I think their platform is still in “beta” but has already done ~$4bn in trade volume and has had 40k unique users.

ARC ($51k)

This project is in the Casino coin theme, and uses a similar model to GMX’s GLP.

And while the flows are against them, other Arbitrum projects with catalysts include:

GRAIL - has been one of the strongest Arbitrum eco tokens out there, and is upgrading xGRAIL tokenomics

GMX - launch of synths is a potential catalyst

MAGIC - GDC could be a GameFi catalyst for the Arbitrum token

rDPX - v2 is in testnet, and they are rolling out zero day options?

PLS - v2 tokenomics and integration with RDNT

Summary:

The TLDR is ARB should “probably” trade above $1 and its not hard to make an argument for ~$2. Smart money is buying some Arbitrum small caps, which could get a boost from the “stimulus” effect of the potential $1bn airdrop. And there are other Arbitrum tokens with some upcoming catalysts that could perform well. Who knows if we get a full on Arbitrum degen season (or have we been having that already?). And in terms of ARB token price action (not financial advice) I am looking to follow a similar pattern to the BLUR airdrop in terms of trading, and will buy more if it trades below $1. As always, feel free to drop any comments or questions below.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. The author holds positions in the ARB, GRAIL, ARC and rDPX tokens, and may be biased.

Could you give a deep dive to ARC ?

Will we still be getting the deep dive before Arb airdrop?