Are We Back? (+ Alpha for You)

A comprehensive guide on where we are, where we're going and some projects I am watching

ETH is trading at ~$2.1k and alts are showing signs of life again after some weakness into the Shanghai update. This post will examine a “data dump” of key indicators to see if this is a time to lean in or be cautious, and I’ll also walk through some upcoming + current projects and developments that I think are worth keeping an eye on.

Macro Overview

The major fears facing the market, including potential sell pressure from ETH’s recent Shanghai Update are started to abate. Markets reacted positively to the US CPI numbers on Wednesday, which were the lowest since May of 2021.

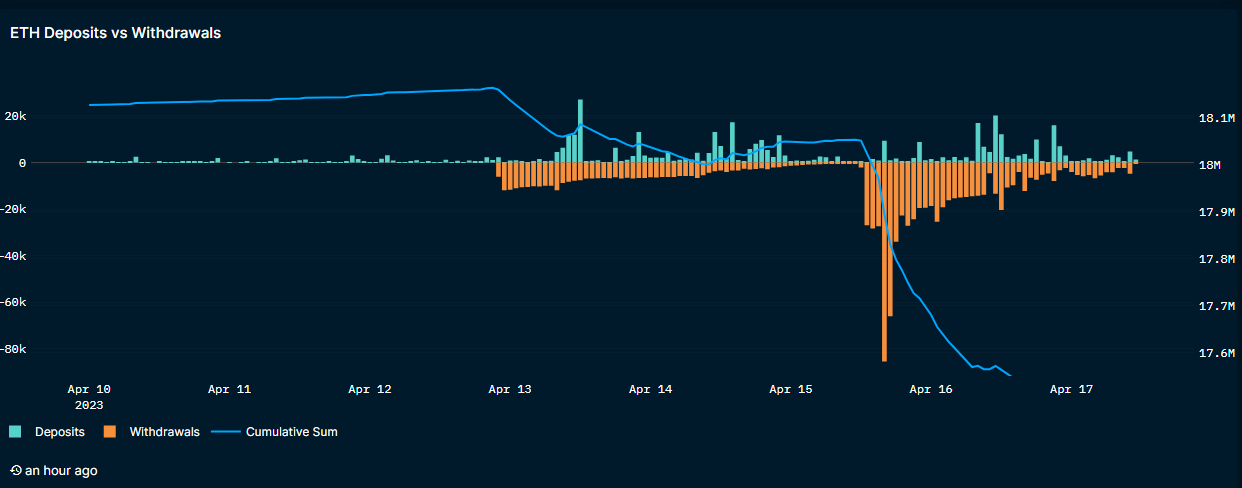

ETH withdrawals have cooled off after a large wave on April 15th, but this is definitely worth monitoring for any future potential sell pressure. The best dashboard for monitoring this can be found here from Nansen.

Side note: the LSD market is still dominated by LDO, but notably Frax has taken ~100bps of market share YTD 👀.

Obviously BTC has been leading mindshare + liquidity in the space, with BTC dominance recently reaching a 21 month high. A case could be made that these gains could start to funnel into ETH → and then alts.

We’ve already seen step one in action, with ETHBTC rallying ~13% from the recent lows. Notably, this ratio sits below pre LUNA blow up levels, and has bounced back following ETH’s Shanghai fears abating.

When ALT SZN? I personally don’t see us having a retail euphoria driven “alt season” this year, given a increasing recessionary US economy and no change in fed policy yet. However, despite the recent run up in ETH and BTC (+73% / 83% YTD comparatively), the market cap of alts (defined as everything outside the top 10 in this chart) is just 28% higher than the summer 2022 lows, 15% lower than the LUNA/May lows and 52% lower than pre LUNA blowup. In short, I think the combination of cooling US inflation + hopefully a pause in restrictive fiscal policy + gains in ETH + BTC lead to some incremental flows to alts. As I’ve touched on in previous write ups, I think it will be highly selective to either “in season” names, where a narrative is catching momentum, or projects that are independently doing very well (I will cover one in particular at the end of the issue).

Looking at TVL flows across the major chains, OP, FTM and ETH have been leading the way over the last week, with only Avalanche seeing negative TVL growth. Notably, zkSync Era has seen 35% growth in the past week, with TVL reaching ~$120mm.

From a positioning perspective, GMX traders are very net long, which raises a bit of caution. Current positioning is ~$177mm of long exposure out of $196mm in total!

On the other hand, smart money stablecoin holdings are at the lowest since the moments before Luna blew up last year. So smart investors are still accumulating and not fleeing to stables. And while all this data would seem like we should be hitting some level of “euphoria” or at least a little bit of happiness, based on the sentiment on crypto twitter, you would not be able to tell that ETH is even above $2k, which makes me think we are at some sort of “disbelief” stage as a lot of traders (and old wallets I still follow) are sidelined.

One last macro point before we dive into what smart money is buying. Current market expectations are for the fed to start slightly cutting rates this Fall, which could also be an important macro tailwind the market has obviously been missing and trying to front run for a bit now.

Where is the Smart Money Flowing?

Nansen smart money traders have flowed heavily into ETH over the past week, with other notable flows into MKR, RNDR, CHZ, HEZ, RPL, GRT and CLV. (Note: because this is token balance driven, not all inflows are “buys”).

Looking specifically at Nansen smart money flows on Arbitrum, rDPX, GRAIL, PENDLE, RDNT, ARB and PLS are leading the pack.

Taking a look at our chainEDGE data (swap only), over the last week (excluding stables), MKR, COMP, FXS, BLUR, ENS, YFI, CAKE and MATIC have been leading the way.

Notable flows over the past day include:

ARB → $300k

FXS→ $245k

CRV→ $234k

JOE→ $80k

BONE → $66k

RDNT→ $64k

And of course PEPE → $40k

From an outflows perspective, we have seen smart money fleeing ETH, RPL, BAL, SUSHI, LDO, GMX, ARB and APE.

Ok so what can we see from our data dump. BTC dominance reached 21 month highs, with ETHBTC recently bottoming and now picking up steam. While positioning is overall bullish, sentiment is nowhere near euphoric. And from a single name alt trading point of view, I think it is a short-term trader’s market for most coins, as they pump and recede with certain narratives, but individual projects with traction are still doing well and the “bid” from smart money is there. We are nearing a particularly weird macro turning point where we more deeply enter the “most telegraphed recession ever” and inflation is slightly but not materially easing. I will do another post on portfolio management but it is worth stating again that the current PVP nature of the market is not kind to long term holds (unless on very established projects, with improving fundamentals and great tokenomics). So personally I have been very tactical with any trading (and most smart money trades I have seen are particularly “quick”, suggesting people are a little skittish at the moment). Let’s examine some existing + upcoming projects / developments that I think are worth checking out.

Keep reading with a 7-day free trial

Subscribe to Onchain Wizard's Cauldron to keep reading this post and get 7 days of free access to the full post archives.