After a brief cooldown period, onchain activity is picking up again. We’ve seen a small spike in smart money activity within onchain alts (like SPX, JOE, BANANA, Starlink, Real Smurf Cat, etc) following this BTC increase to almost $35k and ETH to $1,800.

At the same time, broader smart money (per Nansen) have seen stablecoin holding percentages not seen since January 2022.

We’re still nowhere close to the easy money environment of 2021, but sticking with the tokens that smart money has conviction in (Like HAY, OP, ARB, BITCOIN, SPX, etc) has been a decent place to focus recently.

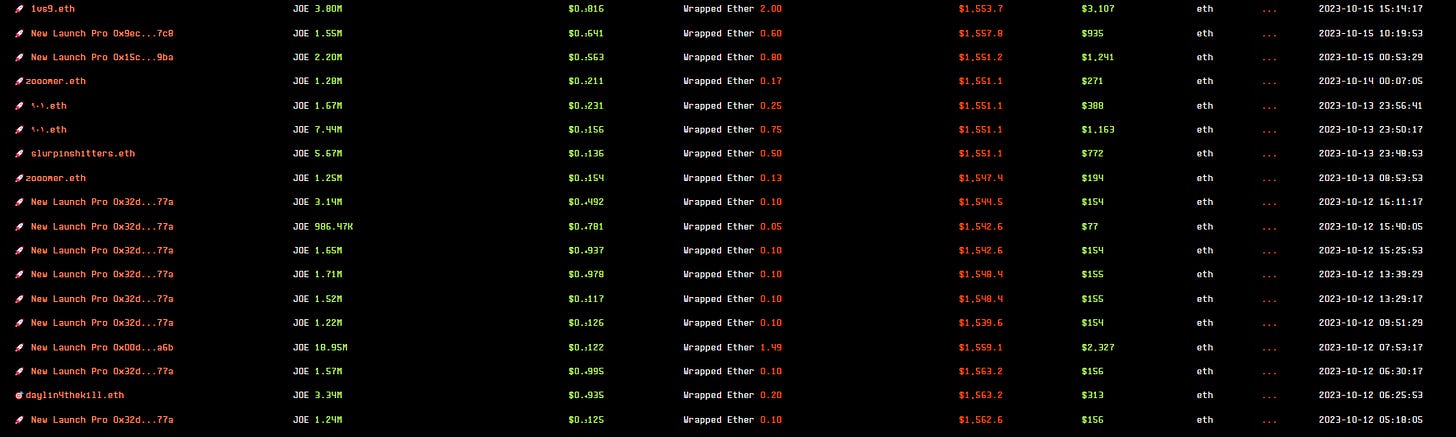

My personal thesis is still that the market can only focus on a small number of DEX tokens at a time (less than 10). Focusing on ones in this category that are either going to see rising attention or finding new ones (ex. JOE) that will enter this category is the easier way to trade the current market vs. focusing on new launches. The new launch game has not only gotten very competitive with the proliferation of sniping and other tools, but most tokens that are launched today are not very high quality. The combination of these factors leads almost any new token to pump really hard out of the gate to $300-500k market cap, and then swiftly to zero. Trading new launches now is about catching sniper capitulation in tokens that aren’t garbage.

Some visual examples of this for tokens that have done well.

JOE launched a few weeks ago, and went straight to $300k market cap on launch day, and then fell to $50k by the following day. Today its $7.6mm

The key (for me) is seeing smart money bid these bottoms to signal that there is still interest in what was a seemingly “dead” token.

Another smaller example of trading the sniper/new launch capitulation was seen in CRAFT. Onchain observers were paying attention to the token after the success of BLOX. In the first 6 hours of trading the token went from zero to $600k market cap, and then fell to $50k market cap by the following day. And then it 10x’d again from those levels in the following 2 days.

In my view, this is driven by less competition / more skill required to discern which projects can make a resurgence from dead to alive vs. most traders just blindly aping new tokens because they are early.

Now for some new launches, the token will just keep going straight up, not giving a pullback, like BLOX.

If you would like to advertise with the 19k strong on the Onchain Wizard's Cauldron newsletter, you can fill out the form here

My Idea Generation Process

With these frameworks in mind, here is my personal idea generation process.

To start, if you don’t have a ton of time, you can tune into our weekly programming where I cover New Launches that don’t Suck.

In last week’s issue we discussed:

JOE at $5mm (now at $7.8mm)

REKT at $7mm (now at $4mm)

ZAPEX at $1mm (now at $650k)

BLOX at $2.2mm (now at $3.2mm)

PINT at $4.3mm (now $5.1mm)

WEBAI at $240k (now at $389k)

MLP at $325k (now $1.4mm)

WAGER at $325k (flat)

Or an average return of 54%

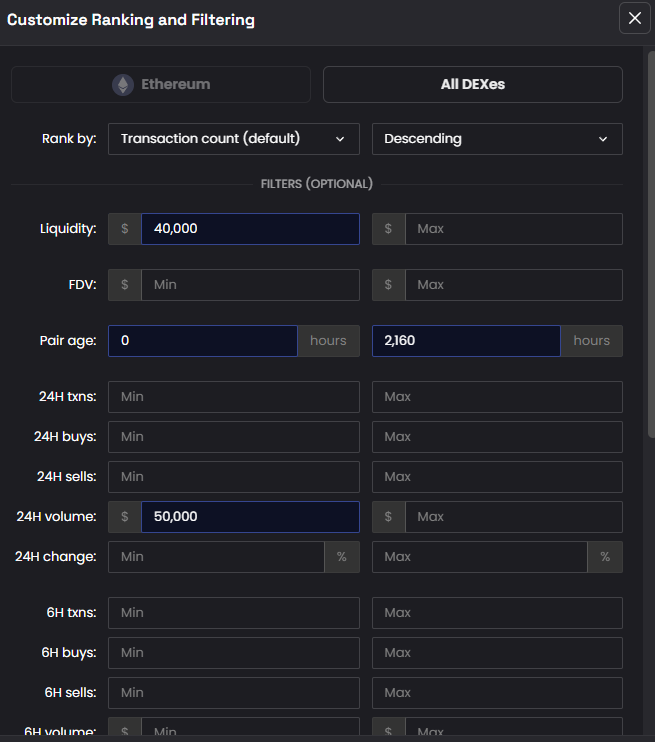

A free way you can filter for where attention in the market is flowing is by using Dexscreener filters. I usually use something like the below to look at tokens that are less than 3 months old, with $40k+ liquidity and trading volume isn’t dead.

Alternatively, using smart money as your idea generation signal, there are 3 ways you can stay on top of new or interesting tokens worth paying attention to.

We recently launched custom TG alerts with chainEDGE, where you can filter by wallet PnL, token age, number of wallets and tons of other customizable filters. A recent example of an alert I got on my filters was for CRAFT at $70k market cap. Taking into account the noise around when tokens are brand new, you can also run these types of alerts/filters with our data for tokens that are 24hrs+ to 5 days old to try and catch the new launch capitulation candle.

Or if you just need a summary of each day’s new launches with data around smart money interest and holding retention, you can use our New Launch Digest

For the more established tokens, I find myself looking at smart money $ holdings vs. market caps to find outliers. Today, HAY, SPX, Real Smurf Cat and JOE would fit into this bucket (especially JOE at just $7mm market cap).

Putting it All Together

The market still isn’t great, aping new launches is not free money, and this space is getting more and more competitive. But this year has still been profitable for those who have stuck around and have gotten better. In the current majors run up, CEX coins have done better than onchain, but we likely see a resurgence soon (and hopefully there is one coin the market rallies around to run it to $100mm). When PEPE ran to $1.5bn earlier this year, it created a small wealth effect despite the majors stayed in place all year, and set us up for onchain summer. If one of the current smaller crypto favorites (SPX?) can run it up to $100mm+, we may get another phase of onchain fun.

As always, feel free to share how you are finding profitable token ideas, and if you need help finding interesting tokens, check out the weekly New Tokens That Don’t Suck or try using chainEDGE.

Stay safe and have fun.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Amazing thread as usual Wizard! Thanks

good stuff!