What a crazy last few days. I wanted to put together a summary timeline of events that got us to this point. Also, for paid subscribers, I will have my piece on some degen token ideas + how to find them on Saturday morning (yes, these can still work in a bear market).

The Timeline:

To begin, if you aren’t familiar, let’s start with a quick overview. Sam Bankman-Fried (once worth $30bn) is now worth much less. His exchange, FTX, was once worth $32bn back in January and is now insolvent. How did we get here?

The Beginning of the End:

Now that we have the details, we can start to see when things went very wrong for FTX. Obviously, SBF also ran Alameda Research, a multi billion dollar crypto trading firm and market maker, “alongside” the FTX exchange. Alameda must have had material exposure to LUNA/UST, and were likely using borrowed money to deposit into the Anchor super ponzi at 20%. Well as LUNA blew up, crypto prices fell significantly across the board, and contagion ensued across the space (with 3AC blowing up), Alameda also ran into its own liquidity issues. Per Reuters, we now know SBF transferred at least $4bn of FTX funds, including customer deposits to Alameda, to prop up the firm. And all of the following bailouts of various crypto lenders (Voyager, BlockFi, etc) were actually Alameda’s way of not going out of business (they had massive loans against FTT, and could not have their lenders go bust, which would topple the house of cards).

Coindesk Article:

The situation heated up in early November, when Coindesk ran a piece on Alameda’s balance sheet. Given the ties of the two firms have always been considered close, Alameda’s balance sheet was perceived as crucial to FTX’s operations. The Coindesk note showed that Alameda had ~$15bn of assets. $5.8bn of which was the FTT token (FTX’s exchange token), $1.2bn was SOL token, $3.3bn of unidentified crypto and $2bn in equity securities. Importantly, the firm had only $134mm of cash on hand in June of 2022, and hundreds of millions of its crypto exposure were in illiquid Alameda backed tokens SRM, OXY, MAPS and FIDA. On the debt side of the balance sheet, the firm had $8bn of liabilities (majority of which was loans). This article made it clear that the price of FTT (which Alameda owned the majority of) was very important to the financial situation of the trading firm, and FTX. The liquidity of the FTT token was very small, trading at $10-20mm of real volume per day in October. So obviously, Alameda could never sell its FTT stake into these markets, without sending the price to zero with haste. This would blow a $6bn hole into Alameda’s already illiquid balance sheet. And $2.2bn of its FTT assets were collateralized by debt. So any rapid decline in the price of FTT means margin calls to Alameda.

CZ Chooses Violence:

The tweet that started it all. The CEO of Binance, CZ, tweeted that he planned to sell Binance’s FTT holdings ($600mm or so) due to “revelations that have come to light”. Specifically highlighting learnings post-LUNA, this signaled something bigger was going on, but most industry observes thought Alameda/FTX would be fine give SBF’s reputation, and that they “never touch customer funds”.

The Alameda CEO (Caroline Ellison) tweeted that they would do an OTC deal with Binance at $22 for its FTT holdings, and then proceeded to delete the tweet. FTT traded down to ~$22 around this time, but industry observers continued to think things were going to be fine.

The Outflows:

Learning from their LUNA experience, crypto users decided to use caution and withdraw assets from FTX around November 6th and 7th. At the same time, Alameda was likely using everything they had to bid up FTT, to prevent its collapse.

On 11/8, FTT stopped receiving buyside order pressure, and started to tumble, from $18 to $5. As concerns about FTX’s solvency mounted, the outflows from the exchange intensified, reaching $6bn in the matter of 72 hours.

On 11/8, CZ made a non binding offer to acquire FTX to help them with their funding shortfall, which was estimated to be ~$6-8bn at the time. The rumored price of the deal was $1, and for Binance to assume FTX’s funding shortfall.

And then on 11/9 Binance announced that they completed their due diligence (in less than a day) and said that they will not be pursuing an acquisition of FTX.

Even Coinbase was asked if they would buy FTX, to which the CEO said “would not make sense” based on some circumstances that will come out eventually.

FTT quickly falls to $2 after the Binance deal dies, and paired with Alameda’s debt position and $6bn of customer outflows, the exchange is, unsurprisingly insolvent. The funding gap is reported to be ~$8bn. On 11/10, FTX suspends withdrawals, solidifying that things are likely over for the exchange. Shortly after, a market opens up for FTX accounts, where people can sell their accounts for 5-20c on the dollar.

Later on 11/10, the Securities Commission of the Bahamas (where FTX is based) froze its assets and applied to begin liquidation proceedings for the firm.

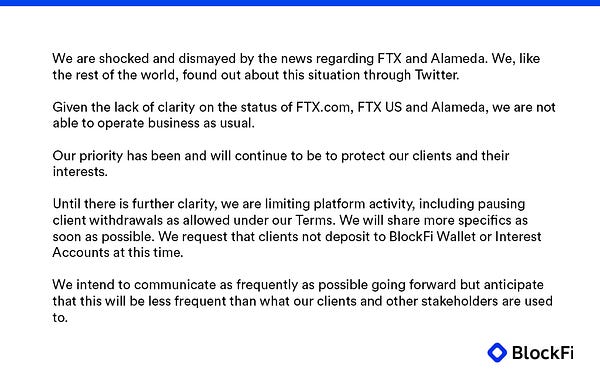

So FTX is now officially deemed bankrupt. And then the contagion begins. Blockfi halts withdrawals:

Genesis Trading has $175mm of funds stuck in FTX.

This is all we know thus far. Alameda got blown up on leverage during the May 2022 crypto crash, dipped their hands in the FTX customer deposit cookie jar, and were propped up by mountains of debt across tokens they couldn’t sell. FTX users withdrew $6bn in a bank run, while FTT plummeted and the rest is history. The SEC and DOJ are now investigating FTX for the mishandling of customer funds. And broader crypto market cap has fallen $200bn over the past week. SBF’s net worth fell from $30bn to much less, basically overnight. What a week.

In closing: If you own crypto assets, it is probably best to get them off of centralized exchanges / lenders until the impact of Alameda’s / FTX’s blowup is known. Stay safe out there, and if you were impacted and need someone to talk to, give me a shout.

Any forecast how long crypto winter will be?

Great summary, thanks Wizard!