As the CT timeline loses its mind over if we’ve topped while getting liquidated trading on leverage, here are some random thoughts on trading attention and that “the cycle” matters less than playing the right games (for shitcoiners). These thoughts are a nice addition to Attention Markets which I wrote back in December of 2023.

#1 THERE IS ALWAYS A TRADE TO BE MADE + ALWAYS TRADE ATTENTION

There are enough gambling participants and enough money to be made that attention flows have and will continue to be alpha. Macro doomers, ETH doomers, SOL simps, cycle top callers, it doesn’t matter. If you follow the “meta” hot ball of money, there are ALWAYS opportunities to profit. If you’re holding massive BTC, ETH or SOL bags and are worried about the cycle topping, just sell + buyback later if you’re scared. If you are LT bagholding some shitcoin, you haven’t adapted. As a shitcoiner, I think its best to operate under 2 environments / modes:

(1) LOCKED TF IN Periods– The time to do this is when you are either early to or mid-narrative. The narrative needs to have attention + volume + momentum. You aren’t holding things too long, and exit when the meta is peaking / has already peaked.

(2) Don’t give away your money Periods – If you aren’t aping into an existing meta, you better be buying something so established + tied to the right tailwinds that it doesn’t matter (like BANANA or ONDO). Or just do nothing. Outside of trading the highest attention Celeb + politics coins, this is definitely where we sit at the moment.

The days of buying a CEX alt for a “long term bag” are mostly gone, while doing the same onchain can lead to terrible outcomes (see what happened to DePin / AI coins). Return dispersions are extremely high this cycle because winners chase and monetize the winning meta and don’t overstay their welcome. But once a real “meta” kicks off, that is where you should be trading, because after all none of these coins are worth anything and you should just be trading attention. (There are always a few outliers to this btw)

Don’t believe me that there is always a trade to be made / a meta to trade? Following the FTX collapse we had:

Jan – March 2023 - ARB SZN, where GRAIL pulled a 30x+ that anyone could have bought. There were also plenty of other ARB runners.

April-May 2023 - PEPE and other memes szn like WOJAK, TURBO, MONG, etc

June-August 2023 – Trading bot szn, with UNIBOT running from $15-> $150 and then all of the beta plays

During the same meta there was also Casino szn, with RLB running and a bunch of shorter term plays on TG casino bots

Animal racing meta also goes down in here

September – October 2023 – Cult meme szn, with things like JOE, Real Smurf Cat, SPX and MOG going on crazy runs

November – December 2023 – SOL onchain heats up, led by BONK going $100m - $1.5bn. WIF had its first run in this group as well. The L1/L2 founders pet meta was also in this grouping.

BRC20 coins also had their szn in this timeframe, with MUBI launching and going wild and beta plays like BSSB, etc

January 2024 -February 2024- AI coins szn, with TAO running $200-> $700. So many AI new launches that printed.

February 2024 – 404 Szn kicks off with PANDORA running from zero to $200mm in early Feb. Tons of opportunities in the beta plays.

March -April 2024 – The truly goofy season. Everything worked during this period. DePin coins worked well, with things like OPSEC, SCALE, GPU etc. This was right when WIF started to take off and SOL onchain really started popping. Bonkbot alone did $137mm of volume on March 17th. AI coins also had their exit pump in here, like NMT hitting $15.

Ordinals like Bitcoin Puppets was another sub-meta that worked well within here

Mid April was the death of DePin, with almost all of them falling 50-90%

Base Szn also kicked off in this time period, with BRETT’s first run ending in April.

April - May 2024 – By the end of April, basically all ETH utility coins died but memes took over. Politics coins like TRUMP surged. The mis spelled name meta on SOL took over, with boden peaking in mid-April as well. Second wave of SOL mooners come to life like MICHI and POPCAT along with the day 1 crazy plays like SLERF and BOME. Late May PEPE peaks.

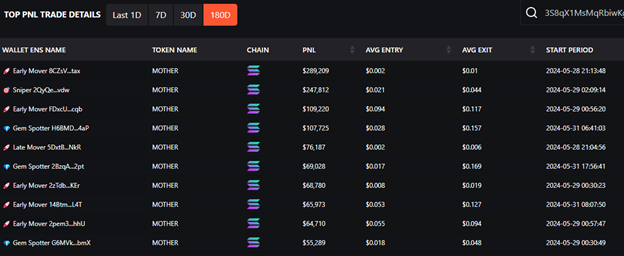

June 2024 – Celeb meta + ETH onchain memes come back. MOTHER runs $2 - $150mm. DADDY runs to $300m. Very brief GME related meta.

The point here is that if you have bags pre or mid attention cycle, you are going to do better than “buying dips” on some dead meta or throwing money into presales (that is another dead one). Another very important point that will most definitely make you, an onchain participant, more money:

#2 ALL COINS ARE MEME COINS

Basically every AI/DePin project has and will be a larp, but if it has a strong enough community, it can do well. These businesses do not need tokens, and the ones that have a cult like community are the ones that actually work. No coin has any inherent value, which is a blessing and a curse. Should Iggy’s Ass token be worth $138mm? Probably not. But did plenty of people print tons of $ on it? You better believe it.

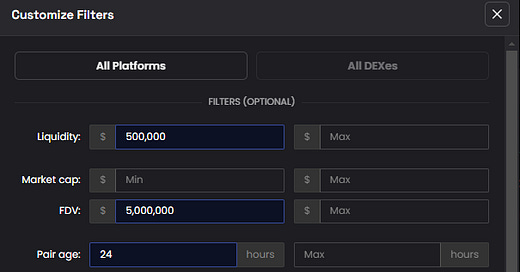

Ok, but how do I monitor attention? An easy one that I run every day (fo free) is using dexscreener filters. I typically use something like the below, I look at what is working (sorting by 24hr gains). And if you do this every day + take notes (takes 5 seconds) it is pretty clear to see what is “working”. Note: if you don’t want to do this yourself + want my commentary on it, you can also just read The Daily Edge. The daily newsletter is dripping with alpha every single day regarding onchain attention, upcoming new launches and what smart $ is doing.

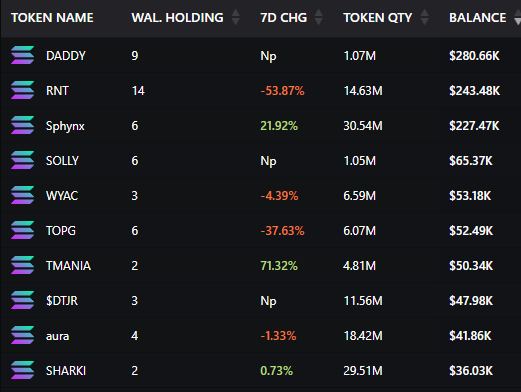

There are more expensive tools like Kaito than can kind of help with quantifying attention as well. Or you can use chainEDGE to do it (it only costs 0.227e for a year of access). I find myself using a combo of dexscreener filters and CE to quantify attention at the moment.

The reason that CE works for this is not only do we have a smart $ algo that is adding money making wallets and removing losers every day, but you can really dive into what they are holding right now on ETH, BASE, SOL, etc.

Being able to view tokens with the highest $ holds from smart wallets

Or for newer tokens aged 1-15 days, can really help from an attention discovery point of view. If you still haven’t checked out CE and want to see it in action (along with me talking through current insights + future releases) come join our Office Hours today at 11am ET (which is also recorded + streamed on Twitter).

We’ve also been building something new in the background to create a more clear picture of where onchain “attention” is using social + onchain data. While still in very early stages (and obviously with an ugly UI right now), the attention.wtf data has shown very interesting results (which also completely backs up everything else mentioned before here). Take MOTHER for example (which is the red part of the chart below). There was an attention spike across crypto twitter + TG + onchain metrics on its launch day. But it then proceeded to retain attention until its peak on the 7th. Because this data is measured on a relative basis, its telling you quite clearly that MOTHER dominated attention from launch until the 7th peak and then got diluted away. And of course the 7th is where the token topped.

Another recent example from a new launch perspective was PEIPEI, which had a huge attention launch, retained relative attention vs. everything else. And then started to get diluted around 6/10 (again where it peaked).

The takeaway, as always, is to trade and frontrun attention. The amount of coins being launched every day makes this cycle much more different from the last. The amount of attention dilution is very real, and you can see it in our rough early cuts of quantifying attention. Following wallets can be great for entries, but for managing a position losing steam / not cutting a winning position too early, you gotta be flexxing those attention trader muscles.

Tools & Resources for attention:

Dexscreener

https://www.chainedge.io/

https://www.kaito.ai/

https://x.com/Attention_wtf

thedailyedge.com

#3 IT”S ALWAYS A HARD TIME TO INVEST / BEARS SOUND SMART, BULLS MAKE MONEY

Two old adages from my HF days that I think are important today. Don’t be a macro doomer, it has paid off 2-3 times in the last 25 years. Crypto is here to stay, even if only as a casino. Lottery ticket sales are at ATH. Sports betting volumes are at ATH. People are struggling to feel comfortable and money printing ain’t going away. Embrace the casino, frontrun the lottery tickets. None of this has any value, but well reasoned crypto gambling is higher EV than sports or casino gambling due to the skewed payout structure. If you extract value from trading attention, sit on your hands when there are no clear plays, develop your edge in whatever way works best, you can make it.

Again, random thoughts and in general my experience from being in the trenches since locking back in during Arb szn. Check out chainedge, read the daily edge. Or build / find your own way to find alpha in the space. Being bearish doesn’t pay out and there is a reason short focused equity investing interest is at all time lows. Find your style, don’t trade things not in your style, build a process and you’ll do better vs. aping into Twitter or TG calls (unless they match your own personal thesis around a meta, etc).

Awesome read, man. The upside is Valhalla, the downside is the life we'd have lived anyway. Fuck it, we ball.