Is Forced Selling Behind Us?

3AC, Celsius Bankruptcy and More

Crypto is pumping again, with ETH breaking $1,200 and BTC at $20,682. I’m not going to call if the “bottom” is behind us or not, but let’s dig into if at least “forced selling” from either bankrupt players or funds facing redemptions.

3AC:

While Su Zhu and Kyle Davies are not cooperating with their liquidators, looking at their onchain positions, the worst seems behind us. Note: if you want to glance through the 3AC bankruptcy documents, you can check out the initial motion here.

So while 3AC may be in a interesting position, it looks like they sold down most of their non-stable positions leading up to this moment. If we first start with the bundled zapper portfolio that I put together, which includes confirmed and thought to be 3AC wallets, they are now holding just ~$33mm ETH and $9mm of wsETH or $42mm of risk. Given they were dumping a similar size pretty regularly in May (I covered them dumping over $40mm in ETH just in a few days here), I think this is pretty manageable from a forced selling perspective.

Alternatively, if you use the Dune dashboard for 3AC’s holdings, they are basically down to just stables ($100mm+), and a small $9mm cETH position.

So far so good from 3AC’s onchain holdings perspective (mostly stables, no debt, minimal selling pressure). There will still be contagion from the firm’s insolvency for sure, but from what we can verifiably quantify, the worst is behind us (again, just from a forced selling of digital assets perspective). Now let’s examine Celsius.

Celsius:

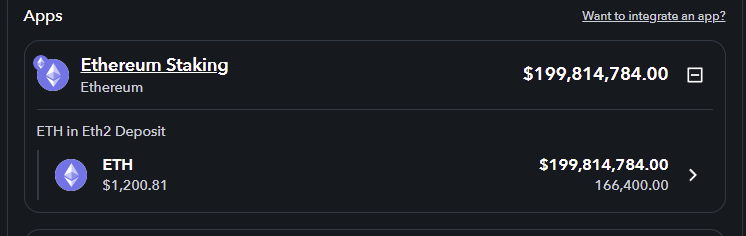

Using the 11 main addresses per Dune, I put together a zapper for the Celsius portfolio. So the good news is that they paid down all their debt against their positions, but looking through this, they still have ~$219mm of wBTC and $200mm of 2.0 staked ETH.

Given that the firm just filed for bankruptcy, including having over $1bn deficit, these positions could be sold into the market to pay back creditors.

Not pretty: Celsius owes customers $4.7bn (or $5.5bn in liabilities in total), and excluding worthless CEL tokens, the asset side of the equation here is just $3.7bn or a $1.8bn hole. The company is also burning what looks to be $57mm/month, which does not help user recovery values.

It is also important to note that the company’s claimed digital assets as of yesterday (ex-CEL) are $1.8bn, which if is still accurate, means we could have some forced selling to come ($1.8bn is a lot of weight to move, unless of course they can OTC it with Alameda or other larger funds/market makers). Now given this is a Chapter 11 (not Chapter 7 liquidation), there is a chance that the business remains, Celsius depositors receive some amount of recovery on their assets, but its digital assets remain unsold.

Anyone else?

While there are rumors of more exchanges going down, for now these are the major players to watch. I’ve covered that we’ve seen some funds going through what looks like redemptions (which have been funded via selling alts) - but most of these have been much smaller size ($20mm and under), so not a major overhang on the market. The biggest overhang still out there (outside of 3AC + Celsius) is the Mt Gox unlocking of ~150k BTC. This likely keeps a lid on BTC until it is resolved.

So is forced selling entirely over? Not yet, but we’re getting closer. While 3AC’s positions are not a factor anymore, I’m still watching Celsius’ potential selling impacts + Mt Gox unlock effects. Hopefully we’re past the bottom in the market, driven by forced selling, macro fears and contagion fears. While there is still some 3AC contagion out there (Voyager bankruptcy, Blockchain.com’s 3AC losses, etc), it seems like we are moving towards “the worst is over” narrative.

What else to watch: While Wednesday’s June inflation print was rough (40 year highs), we’ve seen commodity prices sell-off since, so hopefully inflation finally peaked in June and eases in July and onward. Easing inflation takes pressure off the Fed, which could lead to an incremental improvement in monetary policy going forward, hopefully bringing a bid back to risk assets.

Feel free to drop any comments or questions below (or let me know if I am missing any other major forced selling catalysts out there).

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

I feel like we still have a fair bit further down before 'max pain' is inflicted. Also because equities haven't sold off enough either. What's your opinion on this?

It will be interesting to see how the degree to which crypto market is effected by the falling economy vs inflation and interest rate hikes. Some analysts are predicting that the Fed will be forced to backtrack by Nov. and reduce rates or start printing money, as the economic fall will be too great for the Fed not to act. I think till then we are going to be in this sideways market phase.

Do you think the crypto market will see another correction if the Fed increases rates by 100 bps during the next FOMC meeting, as many predict, or has the market already priced it in and are now looking at other Macro factors?