Issue #1: Playing an Insiders Game as Outsider

Issue #1: Playing an Insiders Game as Outsider

Crypto is a very dangerous place, both on-chain and on centralized exchanges (CEXs) for the uneducated or uninformed. In 2021 its estimated that crypto scammers made over $8bn from exploits, rugs, fake mints and other methods of trying to access your account (even Coinbase had plenty of hacks last year). Whether you are starting with $5k or $5mm, you need to have good security practices to keep your capital safe in this most "unsafe" asset class.

If you are going to be using anything on chain, you need to be using a hardware wallet (ledger for example). Every time you are dealing with any swap, you need to make sure the contract address is correct, while also revoking approvals periodically. Once you start getting a bigger account, you need to learn some basic contract literacy skills. These are must have habits that anyone highly active on-chain needs to be familiar with. I'm not going to go into a ton of deal into these on this issue, but will include some basic overviews in later emails and deep dives in the in-depth course I'm writing.

But this is just the first step of making sure you don't blow through your hard earned cash. Step 2, and the main topic for this note, is understanding that most of crypto is smoke and mirrors. Very rarely are new projects "innovative" at all, they usually have tokenomics that benefit insiders, and 90%+ of all protocol level investments will trend towards zero. Your default state to make it in this game, is to realize you, as an average participant, are an outsider.

To truly have any success, you have to unlearn the way most people teach the game. This includes to stop chasing "pumps", not buying celebrity NFTs, and not finding tokens from shills on twitter. Once you realize how easy it is for a new token or protocol to be set up, you'll start to realize that you should only be investing in tokens with either a proven, actual moat, a future moat that you think is under appreciated, or you are just so early in terms of valuation that the prevailing narratives will bail you out from a unsustainable token and there will be a greater fool to buy from you.

If you don't believe me, take a scan through Fiverr searches for "build a NFT marketplace" or "build a DEX" and you will find some examples of projects that got to real market caps ($100m+) that were just made by freelancers, promoted with hype, and ultimately lost 90%+ of their value.

To be clear, you can make money investing in projects like this, but you HAVE to be early, and have to find some conviction that (1) whatever they are trying to build is at least somewhat different or (2) you think that prevailing narratives could give a temporary tailwind to this token.

$TIME (Wonderland) is a good example. I have friends in TradFi that texted me late last fall saying "omg bro TIME is going to pay for my mortgage, this is sick". I saw videos on tik tok of people saying "try out this new crypto for passive income". Obviously if you have been following TIME since, the outcome was disaster for anyone involved (lost the majority of its value). You can attribute this fall out to the Sifu Scandal, the downfall of the ohm ponzi rebase model, or the death of the Dani halo. But also, to be clear, TIME never built anything other than a community, tried to pivot its business model at least 3 times and had highly dilutive tokenomics (very high APY, sustained by printing more TIME tokens). These "businesses" are obviously not sustainable, but there are still many people (myself included) who bought day 1, and sold when it was all over tik tok.

Why did this trade work?

When it was launched (9/1/21), the founder and former Frog Jesus Dani Sesta was untouchable in the DeFi world, after both usage of SPELL's Abracadabra surged and SPELL's token increased to a multi billion market cap. Additionally, Ohm's rebase token model was still in favor, while the AVAX narrative was heating up. A high risk trade for sure, but buying this one day 1 had a decent chance of success given the information that was available (cult following founder + low valuation + rebase models were hot), and I ended up bagging a ~42x.

Now did I get lucky? Of course, but all big winners like that come with some aspect of luck. If you find yourself in a situation where you are buying a clearly unsustainable token, you have to be asking yourself "am I so early this won't matter" and "what facts do I need to see to know to sell". These types of tokens are trades, and trades only, not something to "HODL".

Looking back, it was clear I was much closer to playing the inside game on this particular trade, than the outside game. By being early, knowing the cast of characters involved and the prevailing narratives, I was buying before it was being heavily shilled on twitter, which is a great start for any idea.

For most tokens and NFTs, you are usually being shilled to be somebody else's exit liquidity. And this is a function of incentives. If you watch early investor + team + insider wallets, it can help you get a sense of what is going on, and where the project builder's true incentives lie. On TIME, you could clearly see the team taking a multimillion dollar salary, and dumping it on the open market aggressively, yet it was still being shilled to the masses.

Don't get me wrong, a cult community is usually a net positive for tokens as a whole. Take a look at the market caps of SHIB, DOGE, ADA, XRP and you will see its more powerful than even having a working product. But you need to have a keen sense of where you are in the hype cycle of any particular investment, to have any chance of realizing outsized returns/success. For every token I buy, I try to score where I am in the hype cycle of it, and this helps inform both position sizing and when to take profits. A good rule of thumb is to take at least your principal out of a trade after it has a meteoric rise, rather than waiting for another 2x (being greedy).

How to play the Insider's Game?

First things first, I think its important to note that trying to scam people on a token or a NFT is not worth it. We just saw two 20 year old's in LA get charged with wire fraud and related crimes for rug pulling $1.1m on the Frosties project, and others have gotten charged in token scams. While alluring, "I can sell out my NFT with a ambitious roadmap", if you fail to execute or outright shut down the project, there is now precedent for the law to come after you.

I don't also want to say its easy, or even likely you will be able to replicate the success I had of running $5k into the 7 figures, but at least with some of the education I'm creating you will be able to make some money, and know what you are doing.

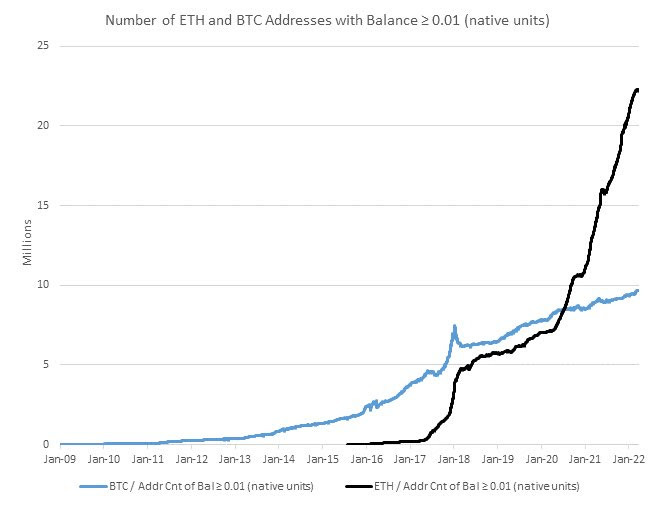

The good news is you are riding a massive adoption tailwind in crypto, unlike anything we have ever seen before. Goldman Sachs' recent chart of the day helps illustrate this point.

To try and play the game as an insider (or less of an outsider), you need to be watching wallets. I've built a very basic list of 50+ wallets that I watch constantly. Watching wallets tells you a lot more information than just what folks are buying. You can piece together which trades are crowded (all the on chain funds + degens you watch are in), you can see what risk appetite is for more sophisticated buyers (what are their stablecoin allocations vs. my own).

I'll do a deep dive into wallet list building in my course, but this is a good first step to ensure you are investing in something with potential, understand where the "narrative winds" are blowing, and if you are taking too much risk in certain environments.

Another key skill, is on position maintenance. Let's say you bought a position that you think will have success because the tokenomics + unlocks are not aggressive on dumping, and you think they are building a business with a future moat. What I like to do is take ~30mins to an hour and build out a "Key Holders List" of what wallets (1) bought early (2) look to be seed investors or (3) appear to be team wallets. And then aggregate what their activity has been like each week or month. I'm more of a longer time frame trader (months or more), so I look for long, sustained moves in my key holder analysis.

When you see insider structures of the top ~20-30% of wallets that appear to be whales, insiders or team members continuously buying, you know you have some sort of edge (or at least a good setup). At the end of the day, we are all highly incentivized creatures, and if you found a project where the "inside circle" keeps buying, it signals that either a short term catalyst is about to pump the price or if the buys are over a longer term time frame, they have confidence in the team of the project (or are on the team themselves), and will be highly incentivized to ship new products, sign new partnerships, etc to increase the value of their holdings. Alternatively, if you see day 1 whales and suspected team wallets selling a significant portion of their holdings, it should be a red flag to get out of the position.

You can also attempt to play the inside game by finding true alfa in project discords. If you have the combination of (1) good, or at least improving tokenomics, (2) whale wallets buying or chilling and (3) you know that a certain partnership, product release, etc is coming in the nearer term roadmap that will likely improve the project's prospects, then you are in a MUCH better position to make money vs. buying a doggy token because a C-list celebrity likes it.

Why share this info at all?

I've had people ask me why I'm writing this stuff, or sharing how to play the game "correctly". And the answer is twofold: (1) education to new users of on-chain protocols is severely lacking, and for crypto to achieve mainstream adoption (and in this case I mean actual usage = adoption, not buying DOGE), we need to teach people how to effectively manage their portfolios, how to have good processes and how to beef up security best practices. And (2), most people want instant gratification and won't put any of these tools into practice. When I say I turned $5k into 7 figures, people don't see the hundreds of hours of research, monitoring, etc that went into the process over nearly a year to get there. People want instant gratification and want to turn $5k into $1m overnight (which if I could do that, then I would have 3 more zero's on my net worth). But the best results will actually come from developing your own conviction in positions and having your own process (built upon learning mine I suppose), that can help you achieve some level of success.

Hopefully you all found some value from this email. If any specific topics resonated with you feel free to give me a shout out on twitter, and if there are any future topics you want me to cover, tag me on twitter with suggestions and I'll do my best to incorporate.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

I am waiting for your discord!

Thanks for sharing. I got into crypto last year too. For me it has been more loss than gain because I did understand the game. But with some of the insights I am learning from you, I am confident things will change for good.