Gm. In this post I’ll go over the narratives driving the current market, catalysts worth monitoring and then new or upcoming launches to put on your radar. On Wednesday I’ll also be dropping a new deep dive piece on an idea I think has quite a bit of potential.

Quick Macro/Meta:

Smart money stablecoin holdings continue to trend downward, suggesting smart money is bullish (mostly on ETH and LSDs). Overall outside of the majors, its still very PvP with narratives coming alive and dying within 24hrs.

Top Narratives:

Trader Tooling - with the revenue generating success of Maestro, and the token success of UNIBOT, this seems like a micro category that will continue to get attention among the few thousand of us left trading onchain non-meme tokens. Some more recent /upcoming launches worth monitoring within this narrative include:

https://twitter.com/Blacksmith0x

https://twitter.com/geniebotapp

https://twitter.com/farmerfrens

https://twitter.com/Cipherterminal

LSDfi - I covered this before, but the valuations of all the LSDfi winners are still very small (ex PENDLE). At the same time, none of the products in this narrative are revolutionary by any means, so tough to say which projects built on top of LSTs will have the most staying power.

Defi Dino Coins - is the DeFi bear market finally over? MKR is up 37% in the last 10 days, with some other Defi 1.0 tokens catching a bid.

Casinos/Gaming - RLB and DMT have performed very well over the last 2 weeks. With everyone shilling RLB and with DMT making crypto games that people actually play, probably worth keeping an eye on these two. I think especially DMT is quite cheap.

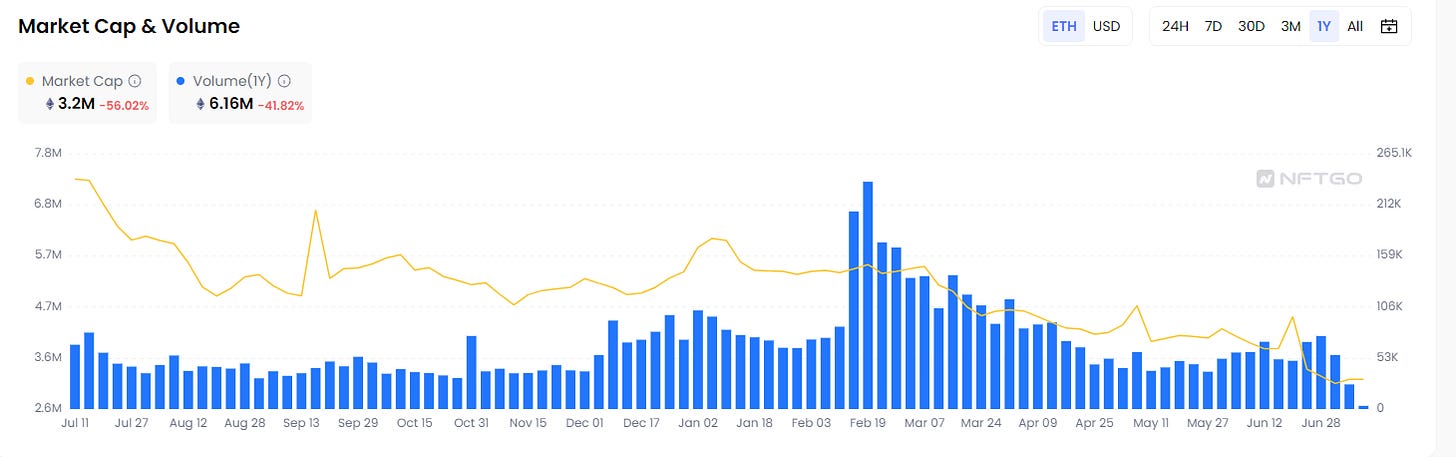

NFT Bloodbath - The NFT market cap is down 46% in ETH terms YTD. Azuki in particular saw a massive decline as they launched Elementals which looked exactly like and diluted the primary Azuki NFTs.

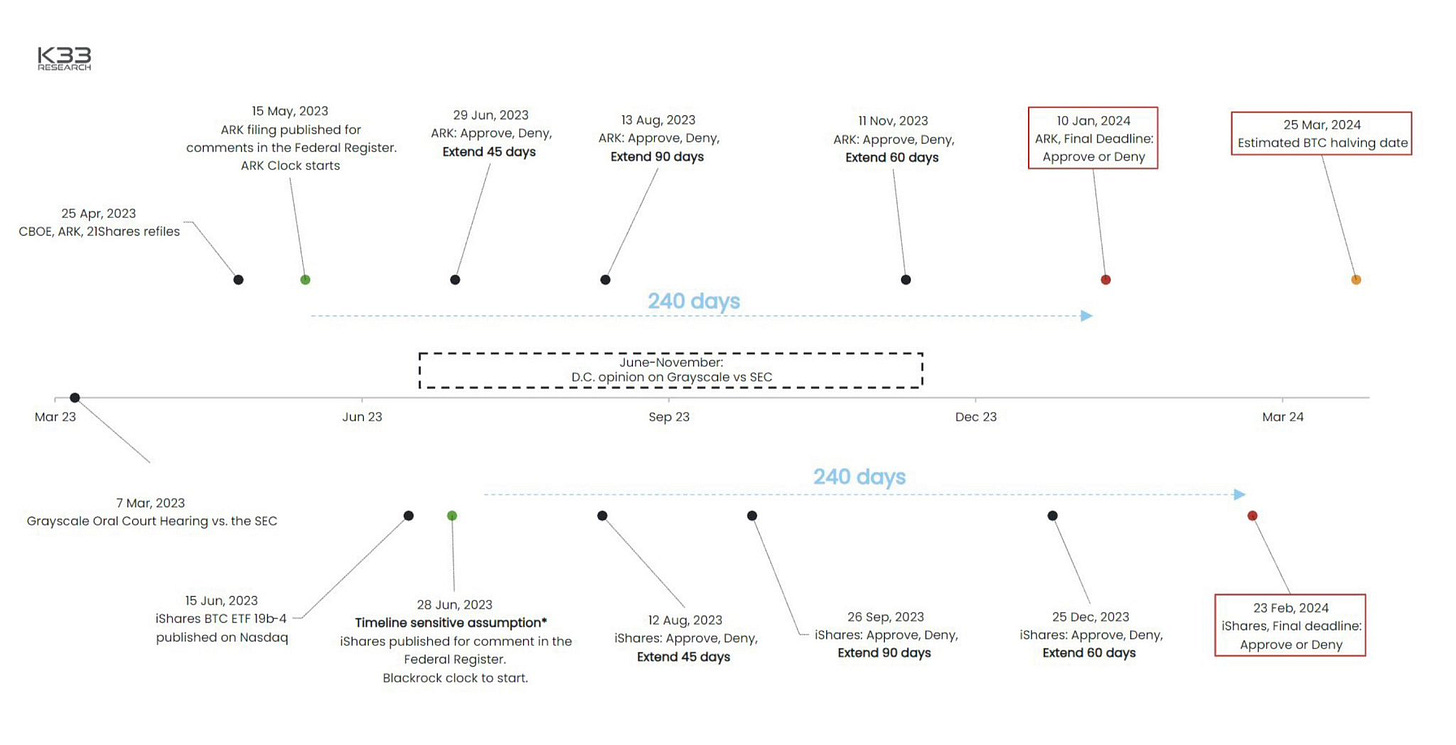

BTC ETF: This one is obviously the most important catalyst/narrative in the market. We could have a decision by mid-August, but more likely in early 2024. Also, the CME is launching ETH/BTC ratio futures in late July.

Catalysts:

Unlocks:

7-11 - 2% APT Unlock

7-15 - 1.74% IMX unlock

7-16 - $30mm or 4.23% APE unlock

7-22 - $20mm or 3% AXS unlock

US CPI on Wednesday 7-12

Prisma Finance launching soon

SpartaDEX has taken their snapshot for their airdrop, representing 2% of its token supply

WINR, the gambling token on Arbitrum, is launching its own chain

Another catalyst worth watching is the launch of WAGMI, which can be expressed through ICE. Daniele knows how to pump a token, and the WAGMI token (for the new DEX) is expected to launch this month

Arkham Token Launch and Airdrop - Arkham is having its TGE through Binance at a $50mm FDV and just announced their airdrop. They also announced an onchain analysis exchange today.

GMX v2 - I feel like I’ve been writing about this for a year now, but maybe its finally getting close?

Perp DEX Wars - GMX has been losing volume market share to LVL and Kwenta.

GRAIL ARB Grant - Camelot is trying to get a grant for $10mm worth of ARB tokens over 6 months, which is ~63% of the project’s market cap. Smart money has been buying into the proposal, so definitely worth watching

New and Upcoming Launches:

https://twitter.com/LimitlessFi_ - Has not launched a token yet. This project is bringing degen levels of leverage to onchain tokens via Uni v3. Project has a lot of smart followers.

https://twitter.com/parallaxfin - TGE upcoming in August or so. Fits within the LSDfi narrative.

https://twitter.com/GNLProtocol - Lending for concentrated LP positions, built on top of GND

https://twitter.com/FlooringLab - No clue what this is yet, but caught it with some smart follower scraping

https://twitter.com/LuminProtocol - Fixed interest rate lending protocol, looks like they are doing a pre sale right now

https://twitter.com/lootbot_xyz - Another TG bot for automation and airdrop farming

https://twitter.com/ChampionsVerse - New gaming project built at Ubisoft

https://twitter.com/Radpiexyz_io - A PNP but for RDNT

https://twitter.com/FatzukiNFT - Fat Azuki’s are funny

https://twitter.com/u_protocol - Layerzero stablecoin project

Summary:

Personally I think the best way to grow your portfolio in weak alt markets is to get small wins in early/private opportunities, so thought I’d share interesting ones here. Most of the liquid tokens are still very PvP, though things could change if we finally get a BTC ETF later this year. As always, drop any comments, questions, etc below. And as a reminder, will be doing a deep dive trade idea Wednesday.

What your opinion for eye bot?

What are your thought about VELA EXCHANGE?

https://www.coingecko.com/en/coins/vela-token