OCW: A Simple Guide to the ETH Merge

This is a highly requested one from everyone, so thought I would put together some high level thoughts about the upcoming Ethereum Merge (as a reminder, a paid deep dive will be out tomorrow morning). I want to note that I am not a technical blockchain expert, so I can’t prove the technical underpinnings of why the Merge could or could not fail - instead this is a guide to get you up to speed on why its a big deal, some resources around the ETH fork, etc.

What is the Ethereum Merge?

At its most basic level, this is a transition from proof of work (PoW) to proof of stake (PoS) for the Ethereum blockchain. I’ll go into why this matters, but if these are foreign concepts to you (they were to me when I started out), I will first lay out what they mean, in an over simplified way. The simple way to think about PoW is that blockchain miners are getting paid per transaction in ETH (to “process” the transaction). There are plenty of resources out there about the technical background of how this actually works, but for our purposes, understanding that proof of work is miner driven and energy intensive is good enough (note: mining requires a lot of electricity usage).

On the flip side, miners in PoS are actually just ETH holders. As an ETH validator (32 ETH required), you stake ETH and in return receive the “mining rewards” or transaction fees from the ETH network. PoS processes transactions different from PoW, where validators (ETH stakers) are chosen randomly through a weighting algorithm that takes the amount of ETH staked into account (again, if you want the technical details, there are plenty of resources available for free).

The process of “Merging” ETH has been in the works since 2016, and is finally coming later this year (hopefully next month). In 2020, the ETH development team launched the Beacon Chain, which is a parallel PoS chain to the current PoW ETH chain. The “Merge” refers to the merger of the current ETH mainnet and the Beacon Chain. So far we have seen various “merges” of PoW and PoS on ETH’s testnets, which can be used to test out smart contracts before launching them on ETH mainnet (among other things). In fact, ETH successfully merged the final Testnet last night (Goerli), which is the last testnet merge before the mainnet merge (the real deal).

The mainnet date is set to be released tomorrow (mid to late September has been the loose timing discussed so far), so given we are likely very close to ETH’s most important upgrade ever, let’s examine why this is a big deal.

What Does the Merge Mean for ETH?

There are many of positives about the merge for ETH, but let’s start first with the narrative itself. BTC and ETH are the largest 2 cryptocurrencies in the world ($470bn and $231bn market caps respectively). While BTC had a strong “protect your money from inflation / excessive money printing” or “digital gold” narrative last year, given how volatile BTC has been, with much less fee activity than ETH, and no natural “yield” for BTC holders, the merge sets ETH up to be the “main show” in crypto (a natural yield asset, that is potentially deflationary, with a better ESG profile). Or how some have called it “Google with a 8% yield”. We’ve already seen institutional inflows reflect this fact - according to Coinshares, ETH inflows were $159mm over the past 7 weeks (up to last week).

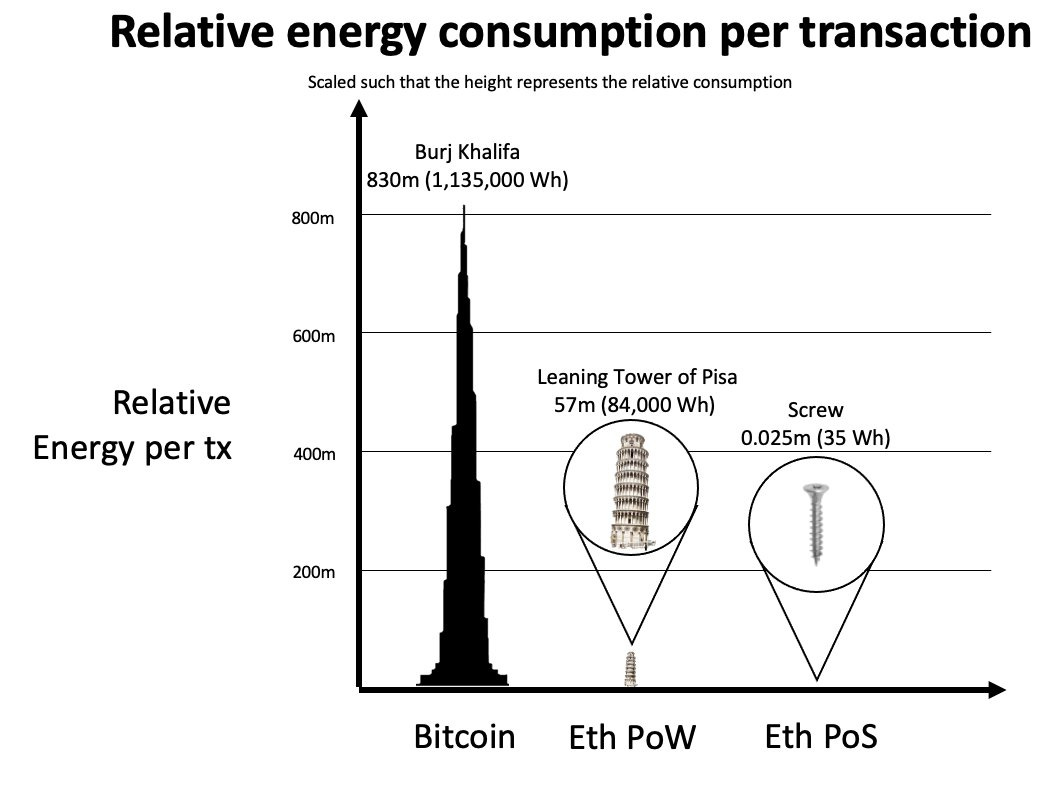

Let’s look into some of the fundamental positives of the Merge (note: the upgrade will not reduce gas costs, at least not at first). The transition to PoS will reduce energy consumption by ~99%, making ETH a much more ESG friendly asset to institutions than BTC’s PoW network.

Additionally, ETH token emissions will fall more than 90% after the transition, to just 500-700k of ETH emissions per year (note the current amount of ETH currently staked for validating is ~13mm).

Looking at the amount of ETH burned in the last month (51k), on an annualized basis this is ~614k of annual burn. If ETH burned outpaces ETH inflation, the token will become deflationary.

While at the same time, stakers will receive anywhere from ~8-12% all-in yields on their staked ETH - more math behind potential yields here:

Putting this all together, the Merge has the potential to make ETH a deflationary, yield bearing asset, with plenty of growth upside as the #1 used blockchain in the world (in terms of TVL), while also having an attractive ESG profile. Lastly, I think the “emissions” to stakers will be treated differently than emissions to miners, which is another nice kicker → miners sell their rewards to sustain their business, so are much more likely to dump, while ETH stakers obviously believe in the ETH ecosystem, and given they hold the asset in size, will probably hold on to more of their staking rewards.

Other Implications:

Once we started getting closer to the Merge, a large Chinese ETH crypto miner began talking about plans to fork ETH:

The major protocols and ETH infrastructure (like LINK for example) have come out and said they will not support PoW ETH. And below is a recent podcast to learn more about potential outcomes and trade ideas around the fork. This probably deserves a separate post, but given this is a fork, holding ETH potentially will make you eligible for an airdrop of PoW ETH or “ETH1”. The primary strategy I have heard some smart traders talk about is borrowing ETH against other collateral for the airdrop, and then selling any proceeds.

ETH1 (PoW ETH) even has a trading market on the Justin Sun owned Poloniex alreadt, which is currently trading at ~$77 (equates to a ~4% airdrop, assuming this would be the ETH fork price).

Closing Thoughts:

This is a significant upgrade for the world’s 2nd largest cryptocurrency, and sets up the best narrative in crypto, which should hopefully lead to continued ETH outperformance vs. BTC (ETH is trading at this year’s high on the ratio). A rising ETH has so far been very good to most alts, so continued upside over time as the Merge approaches, and finally when it happens should lead to more momentum on most alts (especially on still low liquidity). There are obviously risks around the Merge (could be unsuccessful, or get pushed back), but given all the testnet merges have gone over without major hiccups, let’s hope that the mainnet merge goes smoothly. As always, please drop any comments, questions and any ETH1 trade ideas below.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Thanks for the article I learned a lot as always. I have a question, what is going to happen with the nfts which are on the Pow ETH? If I have an nft on eth Pow current price denominated in ETH, what is going to happen with it after the merge?

Great article! I always enjoy reading your market analysis and market perspective. Is there already a discord?