The view that “Gaming” would be the next leg of crypto user growth has lost steam as most P2E economies have fallen apart + token prices have fallen ~60-90% across the board. So let’s look through the opportunity, problems with the current structure, and how Crypto Games could be structured in the future to both attract organic users, but also build sustainable businesses.

The Gaming Opportunity:

According to Take Two, the global video game market size is $235bn per year (in 2022). This is dominated by mobile gaming, which represents ~60% of total gross revenue.

There are now over 3bn active video game players (also according to TTWO), making it one of the largest forms of entertainment in the world. From a pure market cap perspective, the sum of the major gaming companies (examples including Tencent, Sony, Activision, Nintendo, Roblox, EA, Take Two, Bandai, Ubisoft and excluding Microsoft for conservatism) is a total value of over $750bn, which is basically equal to the entire market cap of crypto excluding stables at time of writing.

Compare this to the size of the total Gaming crypto market cap of just ~$11bn today, and you can see that there is at least a lot of potential from a size / valuation perspective.

Or from a pure user growth perspective, 3bn monthly active users is just a tad bit higher than the ~870k we have in crypto games today (3,400x more). Why hasn’t crypto gaming seen more explosive growth? Let’s examine the problems with gaming thus far.

Problems with Crypto Gaming:

First and foremost, it is way too expensive vs. what you get. Spending anywhere from $100 to $1k on upfront NFT buy ins to play some of the lowest quality games I have ever seen vs. spending just $60 and getting to play Red Dead Redemption, Bioshock, etc is a real hurdle that I think a lot of folks overlook. A casual gamer “looking to get lost in another world” can just play any of the current online traditional games, and get a much better experience than running around on Decentraland for example. For crypto games to get adoption, they need to place much more focus on the game, making it fun to play, sustainably monetizing it and making an ecosystem that keeps people coming back (retention).

When I think about the high level issues that crypto games have run into so far, I think about it within 3 buckets:

Truly active crypto investors are mercenaries, driven by earn first, and no emphasis on if the game is “fun” - and teams have solved for this by incentivizing the earn but not the play

It is also much easier to make games in this structure

Most crypto games are way less fun and/or addicting than traditional games

Ex. MANA, AXS, CRA, JEWEL were not even close to enjoyable in my opinion)

Most crypto game economies have been structurally unsustainable

Outside of the games being flat out not enjoyable, problems arise from the core model that most of the popular blockchain games use: Play to Earn or P2E. So let’s take AXS as an example (was the largest gaming token by revenue and market cap at one time). A user could either buy an “Axie” which is an NFT character to battle with in the game, or they could spend AXS (governance token) + SLP (in game currency) to breed Axies. Players battle their Axie’s and earn SLP when they win.

From a gaming economics perspective, think about it this way: when demand for Axies are high → Axie prices go up, → driving higher incentives to breed (to sell), which then increases the price of SLP + AXS. In reverse, if demand for Axies goes down, SLP + AXS should follow. The model works when new users are coming into the system, because Axie demand continues to go up (supporting SLP+AXS) + the NFT sales (where AXS earns revenue) also goes up (supporting the price of AXS). But the “earn” in this case is highly reliant on new users (very similar to a lot of DeFi ponzu yields). Think about if “new” users went to zero. Well now there is no incremental demand for Axies, which also drives down demand for SLP + AXS (for breeding). But then for the SLP market, if just the core group of users continue to play, there will be persistent sell-only pressure on SLP, driving the economics of the user to a breaking point.

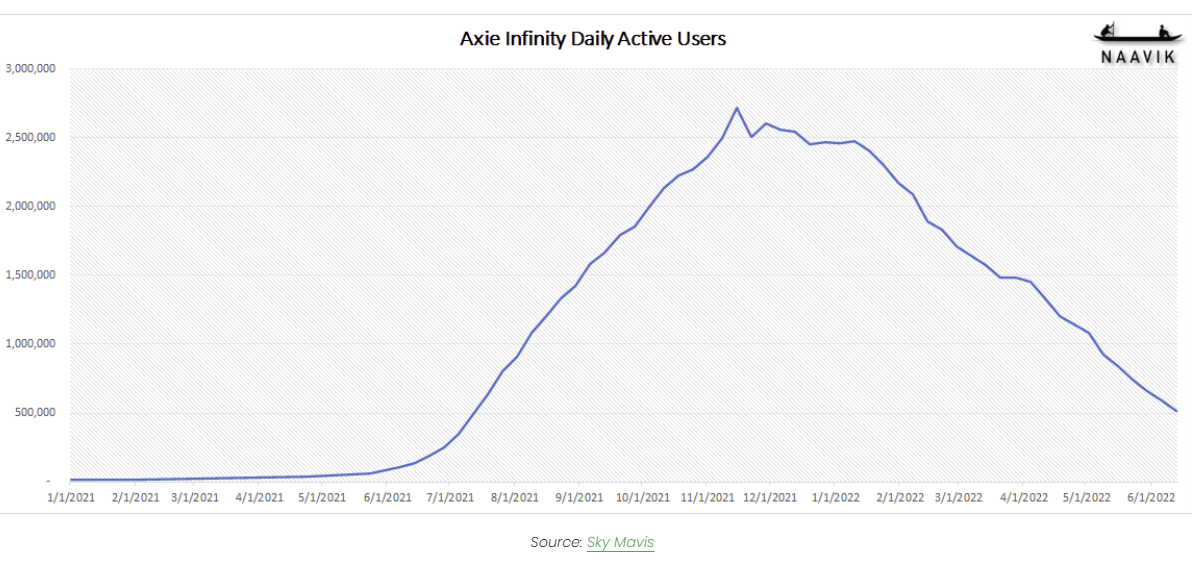

This is basically exactly what happened. At the height of the AXS hype, players were making more than $100 per day ($3k/month), with users in countries like the Philippines quitting their jobs to play the game full-time. The price of the in-game currency soared from 2c in the beginning of 2021 to ~35c at the peak in the summer of 2021.

But as daily active user growth started slow in the fall of 2021, SLP fell back to ~7c and started to bleed out to ~2c (before the hack in March 2022) as user growth went sequentially negative (and the SLP market went into sell pressure only).

As SLP prices fell, daily earnings went from very high to less than minimum wage in the Philippines for example.

Ok so from this example, in the context of AXS, P2E kind of looks like a glorified ponzi scheme right? The model is unsustainable, and relies on new users to keep the game going. And its clear in this data that the only reason people were playing the game was to make money. For a crypto gaming project to be sustainable, I think it needs to function much closer to what traditional games do: make more money than they spend. In AXS’ case, SLP rewards were not coming from their treasury, and they had revenue coming in hand over fist during the boom phase. But fundamentally, players were using the game to make money, and as they made less money, they played it less. Less players, turned into less value for Axies, which then leads to no buyside demand for SLP + sell-side pressure from current players. From AXS’ standpoint as well, the revenue model worked very well during the boom phase ($200mm/month) but as new Axie demand fell, revenue basically bleed out to just $60k/month.

Going through this example, you can see why traditional game developers do not use the P2E model. Traditional games with in-game currencies actually tend to tightly control what you can use it for, and usually don’t let you swap it out into fiat, to keep you in the game’s economy (vs. P2E is the exact opposite). Consider it like a casino. Instead of having a gambler get $1k of chips (fiat for chips), but they can leave the blackjack table at any time (chips back to fiat), for most games, they structure it so that if you spend $1k on in-app purchases, upgrades, etc, it cannot be withdrawn back into fiat (so you have to spend it on the game). And usually players are incentivized to spend this money to make their character’s cooler, better, etc. So for this space to actually pick up some momentum, the focus needs to shift entirely to the game.

We’ve seen similar P2E economy crashes within other popular games, like GMT/Stepn for example. The game had roughly similar economics to AXS, where users needed GST to mint or upgrade their sneakers. And players earned GST by walking. So when users could make up to $50/day just by walking, user growth exploded (and so did demand for the shoes, and demand for the GST token). As user growth went sequentially negative, GST fell from a high of $7 in April of 2022 to just 10c today.

If it is not clear from these examples, a P2E economy with ponzi-esque in-game currency just does not work sustainably over time. So how will the next generation of crypto games build something much more sustainable?

How does Crypto Gaming get to $100bn market cap?

Fun:

First and foremost, we need real games to come to crypto. Games that are fun enough that someone who doesn’t even care about crypto, or that even hates NFTs, will want to play the game. That is an easy draw (gamers will always flock towards fun games), and you are pulling from a very large funnel of gamers (3bn monthly). My sense is that a AAA game gets developed for crypto in the next 6-12 months and starts to show what is possible from a pure gaming perspective

Onboarding

To see massive adoption in crypto games, the user experience to start playing needs to be seamless, much closer to traditional games. Users should be able to play the game first, without any need for a metamask wallet to start. If the game is engaging enough, users will then figure out the crypto side of the equation (not the other way around)

Monetization

The models that will be sustainable in crypto are loosely pay to play, wager to earn and free to play. A simple thought of a very sustainable game structure would be free to play, with in-app purchases available to help you through the game’s “quest”, but also with the ability to fight other players (and wager on it) in a PvP style match

So the revenue opportunities here are:

NFT sales (for new characters)

In game upgrades to level up your character faster

A cut of the wagering pool

Tokenomics

This is not just for gaming, but basically any protocol in crypto now needs to find out how they will be a net profitable business (incl token emissions).

The most sustainable way to do this in gaming is to have in-game purchases done in stables or ETH, while all project revenue is distributed back to token stakers

With some room for mild token inflation in the beginning to encourage game usage + retention

Mobile:

Given mobile gaming is the dominant form globally, the infrastructure needs to be laid out to easily integrate a game into crypto via mobile device.

Based on a quick glance of the current gaming landscape, there are only a handful of projects that seem to be building towards this “sustainable” gaming model - but if there are any that come to mind, feel free to share with me so I can check them out. There is one in particular that I think that has a lot of promise, that I will be doing a paid deep dive on next week. You can subscribe here: http://tinyurl.com/subhereforalpha

In summary:

Crypto gaming thus far has been earn first, fun later, and this theme will have to change for this segment of crypto to drive more adoption. The games themselves need to be structured with sustainable token and economic structures, and move away from the pure P2E model. Onboarding needs to be seamless, with crypto-native interactions only needed to upgrade your character. I think games need to remember that the bigger opportunity is to draw in “new” users to the crypto ecosystem via fun games, not build a game that crypto people will like. I hope this gives you a better understanding of the market opportunity for crypto games, problems with current game economy structures, and what I at least think we need to see to build sustainable games going forward, with real organic users + retention. Feel free to shoot me any comments or questions.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Great post... look forward to your deep dive into the one game you think has a lot of promise. Any comments on Illuvium and its model?

I have been a gamer and big into playing poker now. Gaming needs to be fun and give constant sense of achievement for it to be addictive.

And poker is probably one of the most successful Play2Earn real world games, and keeps making tens of thousands of players to keep coming back to playing poker tournaments even though only 10% make any money and only the top 2-3% make any decent money. What makes people keep coming back - is the pure fun and the high of winning pots (in case of games - winning small battles) or dealt pocket AA or other premium hands and the camaraderie with other players on the table and the wider poker community. And any day I would chose live poker over online poker. By the way WSOP is on these days.

But I really really hope crypto gaming takes off because I believe in owning my in-game achievements and merchandise rather than the game developers owning them and overall vision of decentralisation. Hope we have games that can mimic the fun of poker P2E and be successful and sustainable.

Great post mate. I agree with everything you've said. Not much of a gamer myself but gave a few projects an opportunity. They have all been 0/10 experience. Big problem but even bigger opportunity here to those that get it right. Keen to see your paid post next week