A bit delayed, but this free post will focus on high level mental models regarding tokenomics. As a reminder, tomorrow will feature a paid walk through into the tokenomics + liquidity flows of LUNA/UST (and I’ll be doing a bonus paid post on Friday with whale movements on 3-4 successful wallets I follow).

Intro to Tokenomics:

Broadly speaking, crypto is a very hard asset class to “value”, with narratives driving a lot of valuations vs. “fundamentals”. Chains accrue much more market cap vs. protocols (or Dapps), despite some protocols having much higher levels of earnings power. This dichotomy can be seen when looking at “revenue” for Blockchains and their respective market caps vs. protocols.

Lets look at an example. AVAX, the token for the Avalanche network, has a $23bn fully diluted market cap, and generated $16mm of revenue in the last 30 days. Compare this to Curve (one of the most important building blocks of DeFi) that generated $14mm in revenue in the last 30 days, but only has a $4.5bn FDV.

(Source: Token Terminal).

Given these are narrative driven markets, trying to do comparable analysis just does not work. In addition, you have to keep in mind that “revenue” may be subsidized from very high incentives in the form of a native token, so the true “earnings” may be negative (will go into more detail later).

With chains being their own “countries” where all the Dapps are built on top, they rightly or wrongly trade at much higher valuations (and “earnings” are not a focus). The network level also has much more “usage” for the native token, which may explain the difference. What do I mean? Lets take ETH for example. When you do anything on the network, you pay ETH to miners in the form of a transaction fee, so the native token has more touch points (or demand) vs. your standard “fee accrual” token like SUSHI.

So is it all a crapshoot? Yes and no.

As mentioned at the start, it is very hard to come up with a “true intrinsic value” for most of these tokens. Using just an earnings multiple approach has issues due to (1) protocol revenue is usually driven by increased speculation + leverage, so as markets cool off, so does revenue, (2) not all revenue is created equal, and can be artificially propped up by high token incentives, and (3) the highest valued tokens in crypto are all L1s or their own blockchain, and the value moves up or down based much more on narratives or improving user/transaction counts/TVL than earnings.

“Ok so you’re basically saying its impossible to value any of these tokens with a high degree of accuracy”. Yes, because crypto is not an efficient market, and a lot of the large cap tokens have no “intrinsic value”.

Then why focus on crypto at all? Because when a token transitions from having no narrative + less usage, to increasing usage + picking up a narrative, in a more stable market environment, the token can increase in value by 2-50x+ (sometimes in a very short time frame). The lack of valuation frameworks is both a blessing and a curse, as prices can move a lot on marginal improvements, especially in lower market cap alts (where liquidity is not very high).

I think sometimes its important to actually think about why a token should increase in price at all. Just like any other market, you need more buyers than sellers. I’ve mentioned that I focus more on protocol level investments due to their higher risk, but higher reward nature. So what sets apart a token that goes down -99% over time, and one that stays alive? Tokenomics + usage.

At the protocol level, most of these tokens have a “fee accrual” model. Meaning you can stake your token and receive your proportionate share of fees generated by the protocol. But the real “alpha bursts” or periods where the tokens go up a lot vs. their base pairing (ex. ETH for most DeFi) are on changes in expected fees in the future, not fees today. My personal best crypto investments came before a protocol had hype or usage, and then both took off together. Saying XYZ token is cheap because it generated $Xmm/month during a bull market does not mean as much, and the real juice is created when earnings expectations go from zero/small to materially higher than anticipated. But as we’ve seen with the more mature DeFi protocols, once the steam slows and growth slows, the multiple compresses as people rotate into higher growth opportunities (or just back to safer major L1s).

When looking at a token, you should be able to map out or answer a few questions to help figure out if your token will make money:

Why people will use the product?

How is this usage being incentivized?

What are the token’s supply side dynamics (lockups, circulating vs. FDV)?

How does the token make money or increase in value based on increased usage?

What are the implied expectations based on its current market cap?

How does liquidity mining or other incentives compare to the liquidity + volume traded of your token?

Is it more than just a fee accrual tokenomic structure?

How does your token flow through its native ecosystem?

Keeping in mind that (1) token prices are forward looking vehicles to speculate on the future of a project, and (2) that you need more buyers than sellers, I think if you can answer these questions (and have some hard upcoming catalysts), you can put yourself in a position to make money against the base trading pair of a token - with the caveat that most alts are just higher beta vehicles vs. the base pair. So as long as your base pair is increasing (vs. ETH falling daily now), you can make “alpha” against it if you know what you are doing.

How can you do this yourself?

I’ve went into this a bit in my “intro to researching a project” post. But the most important thing you should be able to map out for yourself is why should this token go up. Breaking this down further, given these are higher Beta investments vs. the base pair, you need the majors (and traditional markets) to cooperate first. With a falling base pair, your ability to make alpha is going to be much, much harder.

So part 1 is you need to have some bullish (or at least stabilizing) base pair - which could be ETH going into the Merge this August. Then, I would look at how does the token flow through the ecosystem you are looking at. Especially in this market, understanding your supply side structure is very important. When thinking about token flows, your goal should be to understand what are the key drivers of why the token could go up - which can be loosely broken down into:

Base pairing stabilizes or increases

The token is a value accrual or other tokenomic structure that improves with more usage (and usage is improving or will improve)

There is not a flood of tokens coming to market in the form of LP or other rewards or insider lockups.

This all seems so theoretical in the current down only every day market, but it does inform which tokens will go down more. Lets look at some examples to showcase it.

Examples:

Reminder: With the appetite for risk assets spiraling towards zero, tokens that keep building and that don’t have nasty supply side structures will do better than ones that have abandoned communities, deteriorating usage or heavy token emissions.

SUSHI:

Once a heavily shilled #2 DEX to Uniswap, SUSHI’s token has fallen 87% over the last 12 months vs. a -28% fall for ETH. So part of the decline here is obviously Beta to ETH (see #1 above), but also #2 and to a lesser extent #3 are at play here. Volumes (and fees) for SUSHI on ETH mainnet have fallen dramatically over the last 12 months, from $900k/day of fees to xSUSHI stakers to sub $50k/day now (-95% decline)

- so demand for the SUSHI token declined as the yield offered to you as a staker plummeted.

Source: https://app.sushi.com/analytics/xsushi?chainId=1

While the token emissions weren’t terrible - with total circulating token supply increasing just 9.4% over the last 12 months.

SUSHI is an example of a token where base pairing declines + drying up value accrual (and usage) led the token price downward, while token emissions did not help, were likely not the major driving factor.

GMX:

GMX (the decentralized, anon-founded, on-chain levered perps protocol on Arbitrum + AVAX) has only seen its token price fall 10% YTD, while ETH has fallen 49% (talk about outperformance). There are very few DeFi protocols that have outperformed this way, and I think digging into GMX’s tokenomics shows why. GMX uses a

2-token model, with GMX being the “value accrual” token that receives 30% of the platform’s trading fees, while GLP is the counter party to levered perp traders (and receives 70% of trading fees). Because there has been very little liquidity mining or trader incentive rewards, and no VC investors in the project, its circulating token supply has increased just 8.5% YTD. So the GMX model is much closer to what I call a “true yield” protocol, where the revenue/earnings are real, and sustainable, despite having its revenue being tied to levered speculation in crypto.

And because you can speculate on both upward and downward moves on GMX, revenue/day has actually increased from December 2021 levels. As has the number of new users.

GMX is an example of a self sustaining protocol, that is not punished by token dilution and has organic, growing usage (even in a down market). Unsurprisingly, despite being a lower liquidity/market cap token, GMX has been a great performer YTD all things considered.

JOE:

Trader Joe, a DEX and lending project on AVAX, also has a similar value accrual token design, where you can stake JOE for xJOE to receive trading and lending fees. It rose to popularity when AVAX (its base pairing) received a lot of attention in the fall of last year, but its token price since August has fallen ~80% while AVAX is down only 43%. So again, part of the move is driven by Beta to the base pair asset.

But also, daily protocol revenue for xJOE stakers is down ~50% since → so the yield you get as a staker has been under pressure.

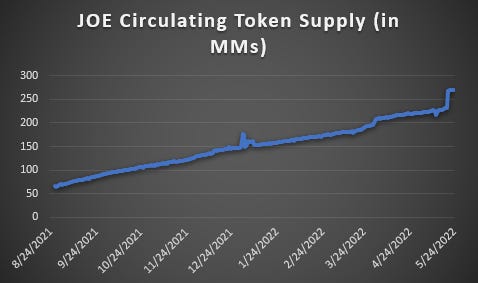

But the likely most important driver for JOE, is that its usage was heavily incentivized by token emissions. Given there was heavy LP rewards to drive liquidity to its AMM, the token supply has increased 4x.

Given JOE is a lower cap token with only ~$9mm of daily real volume YTD (per Messari) these token emissions (which averaged about ~$800k per day) were material in comparison to trading volumes, which exacerbates price movements downward. JOE is an example of where all 3 of our indicators (1) Beta vs. Base Pair, (2) value accrual and (3) heavy token emissions (compared to trading volumes) all worked against the token.

In summary:

Hopefully this gives you some color on how to think about tokenomics, but also more broadly on how to approach investing in crypto protocols. While not groundbreaking information, I think it is important to realize how big of a factor declining fundamentals and high token emissions can have on a project, and my hope is that this helps each of you either lose less money today or make money at some point in the future. By no means is this exhaustive, and there a tokens with worse tokenomics that still can do fine, I think this is a good framework to at least be thinking about as you research and invest in crypto projects. As always, let me know if you have any questions about the content, and remember paid subs have 2 posts coming their way this week.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Thanks for writing this.

Excellent ! Worth the wait.