Perp DEX Szn

Fallout from FTX is driving more capital away from CEX trading and into the onchain perps market. In this deep dive, we will start with free info on who the current market share leaders are and where the smart money is flowing and then round it out with a small paid portion on which upstarts are taking share / are worth paying attention to. Note: monthly whale watching will finally be out tomorrow, and will be a deeper issue than usual given the delay. Also paid subs will be getting discord invites on Thursday

This is one of the hottest narratives in the market right now, so finding where upstarts are catching product market fit (or are about to) can position you to find gems in the current market.

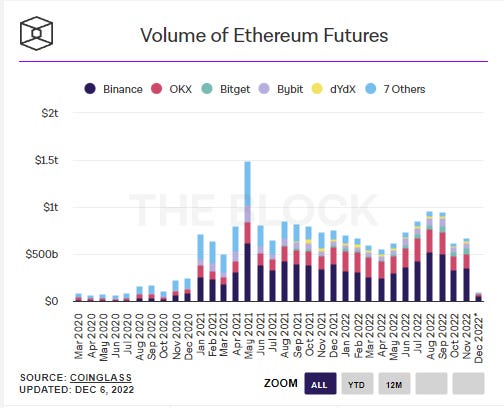

According to Coinglass, total CEX BTC + ETH future volumes were a cumulative $1.3 trillion in November of this year. This compares to ~$40bn over the month for GMX + DYDX. Excluding the longer tail of perp/margin trading DEXs, that implies onchain leverage/perp trading is only at ~3% of CEX volumes at this point, suggesting plenty of upside from a market penetration point of view.

But who is winning the onchain leverage trading race? Currently, GMX and DYDX dominate the space: DYDX had ~$27bn worth of volume over the past month:

While GMX did ~$11bn of volume in November.

This dominance comes through in the valuations of the 2 protocols, with DYDX trading at a $1.7bn FDV and GMX trading at ~$441mm. While there still may be money to be made in allocating to the current winners, I think watching the smaller projects in the space can lead to more upside if you pay attention. Let’s look at GNS as a case study of this in action. Volume on gTrade over the summer was ~$30mm on a 7-day moving average basis, and exploded to ~$80mm in October.

This coincided with basically a 3x run up in GNS’ token price as the leverage trading DEX narrative along with increased usage drove capital into the project. GNS’s volume now puts the project at a solid #3 behind the main 2 players, with $2bn of trading volume in November. And the GNS token is near putting in ATHs.

So where is the smart money flowing within the Perp Dex ecosystem?

Let’s examine it using chainedge.io data.

DyDX has minimal inflows or outflows from chainEGDE and Nansen, so not much excitement there.

GMX is still seeing decent inflows over the last 30 days, with nearly $1mm net coming in on Arbitrum from chainEDGE smart money traders (see dashboard below)

We haven’t seen any smart money movements on GNS over the past 30 days

PERP has seen $233k of net outflows over the past 30 days from chainEDGE smart traders

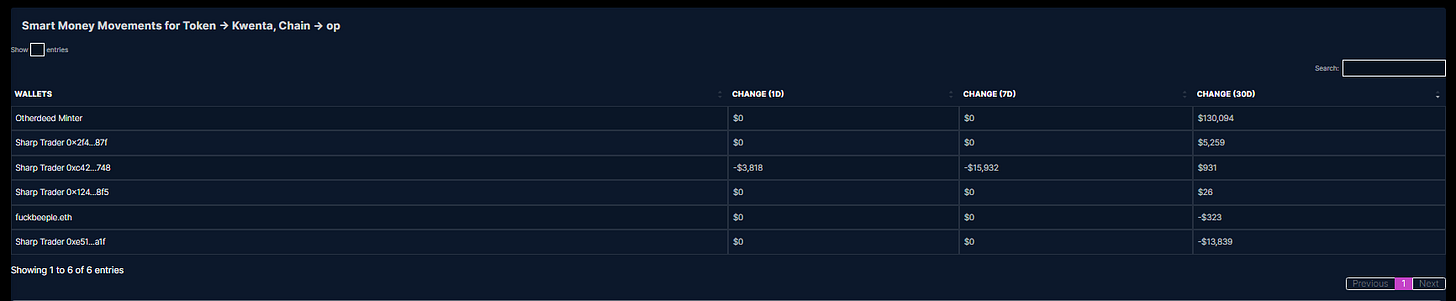

Kwenta on Optimism has seen ~$122k of inflows from chainEDGE sharp traders

Ok, so what are some upcoming / newer projects are worth keeping an eye on here?

Keep reading with a 7-day free trial

Subscribe to Onchain Wizard's Cauldron to keep reading this post and get 7 days of free access to the full post archives.