Summertime Sadness

An overall everything guide to where we are in the crypto cycle, what smart money is buying and what narratives are driving the market.

Note: We also have a big content slate coming up next week, including monthly (paid) whale watching on Tuesday, a guide for LSDfi on Friday and in the following week will be sharing a deep dive on a LSDfi project where the paid discord community will be able to access an early token round.

Where are We in the Cycle:

This is obviously my opinion / interpretation of where we are. Firstly, I think there are a lot of near term bottom signs flashing right now, including:

Crypto majors have largely shrugged off recent Coinbase and Binance lawsuits, including Binance US shutting down USD withdrawals. BTC and ETH are down just ~6% and still much higher than the lows from 1 year ago

Monthly spot exchange volumes recently hit a 1 year low, hitting just $423bn

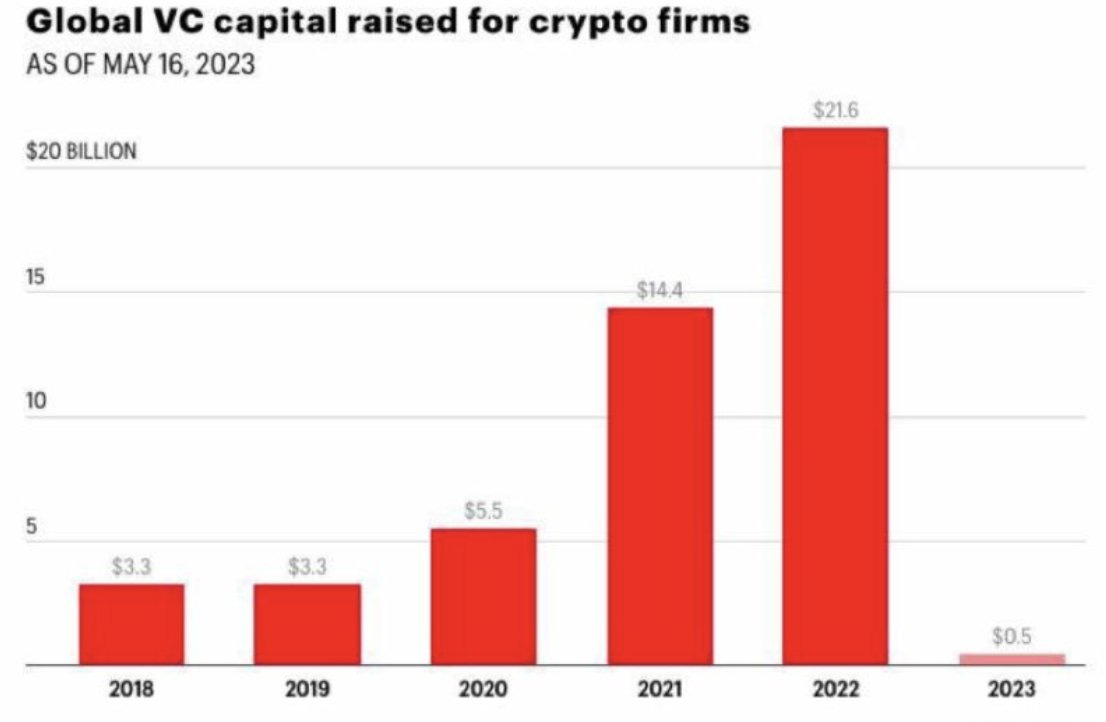

VC interest is also drying up (I think this chart is wrong, but went viral with many folks on Twitter clowning on crypto)

The sense I get from the overall sentiment on crypto twitter is that some are questioning whether to stay in the space at all, while others are just bored at the price action, lack of volatility and lack of major narratives

AI is transferring interest away from crypto

Meanwhile, smart money continues to deploy their stablecoins, with stablecoin holding ratios down to pre Luna levels:

Overall, it feels like the sentiment around crypto has not been this negative since FTX/LUNA, and with macro liquidity headwinds hopefully abating by the end of this year, I think personally we are within ~10% of a near term bottom on the majors.

What Narratives are Driving the Market:

Memecoins - The meme category is still dominating DEX trading volumes (though is losing steam) with PEPE leading the way. Andrew Kang recently called for a near term bottom in PEPE, which if it bounces likely leads to some renewed momentum for the broader meme coin category.

LSDfi - This is probably the largest fundamental narrative over the summer, which I will put out a separate guide on next week. But the high level summary is there are ~$18bn in staked ETH deposits (which only represents a sub 10% staking rate). We are seeing a proliferation of projects like LBR and USH that act as almost layer 2s for liquid staking assets, and will be the hottest narrative over the summer.

Trading Tools - With memecoins driving a lot of DEX market attention, there has been a lot of interest in bots to help trade these tokens, with the largest TG bot making $4mm/month. After the success we’ve seen in tokens like UNIBOT which minted $100k+ realized gains for a number of smart money traders, I think this is a smaller, but notable narrative to keep track of / look for new innovative projects in.

Arbitrum Low Caps - The last narrative (and the smallest by far) is the quiet success of a few recent launches on Arbitrum, including GHA, WAR and CHOKE. If you want to dive more into this particular narrative, would reccomend checking out Andrew’s thread here

What is Smart Money Buying:

chainEDGE smart money (which filters for the highest realized PnL Dex traders in the world) has seen some notable flows, which can be broken down into:

Majors + derivatives (ETH, ETH staking derivatives, BTC)

We’ve seen over $75mm of net swap inflows for this category over the last month and a smaller amount of net deployment of stablecoins. This means that smart money is mostly rotating their already deployed token holdings into majors, and deploying a smaller amount of stablecoins. Overall a bullish signal for the overall market.

Memecoins

Over the past month, the largest inflows for the meme catgeory have been into Psyop, RFD, MRF and BIAO. In the last 24 hours this has been mainly been into PEPE and HarryPotterObamaSonic10Inu (lol).

Real Projects

Over the past month, the largest flows have been into MKR, CAKE, 0X, LBR and USH

As mentioned, monthly (paid) whale watching will be next week, which includes a much deeper dive into these movements, and wallets to watch.

In Closing:

Despite market sentiment, I am leaning bullish based on smart money accumulation in the market, a number of “sentiment bottoms” and a hopeful reversal in macro conditions later this year. LSDfi will be the big narrative over the summer, and if you are looking for scrappy/degen opportunities, I would investigate + hustle on new launches to try and build up your portfolio (not NFA obviously). The market also hasn’t been overly spooked by SEC lawsuit announcements, which is another encouraging sign. Trying to keep it short and to the point, but this should give you a clear overview of where we could be in the cycle, what the data says, what smart money is doing and which narratives will drive the market over the next few months. As always, drop questions comments or narratives you think I missed in the comments.

Amazing, as always! Thank you wizardd

Killer as always, thanks Wizard!