This is going to be an eye opening, thought provoking and *potentially* annoying post, but it will most likely make you a better crypto investor. It’s almost a diary of my own personal crypto investing process, why it has changed, and how I am still making money in today’s “dead” environment.

Paid subs: I have finally hired a content team to help me out, so expect a lot more from me going forward. On Monday our new series of “New Tokens that Don’t Suck” will be issued smoothly into your inboxes.

Changing Your Colors

Chameleon’s sometimes change their color to “blend in” or camouflage themselves from predators. And today’s piece is about “blending in” to what is making money in the market. To start a short story. For those unfamiliar with my background, I come from a Hedge Fund “fundamental research” training ground. You know, the nerds who are analyzing the key drivers of stocks, doing channel checks on if they could beat/miss analyst estimates, etc. But one thing from my time working in the industry I will never forget, this “Chameleon” Billionaire.

This individual ran a decent sized fund, with $5ish billion in assets under management. Before working at this particular fund, I used to think the big money came from being contrarian, kind of like the infamous Michael Burry from the Big Short. Betting against everyone else, waiting for the day you were right and the market, the “dumb money” was wrong. But this Billionaire portfolio manager opened my eyes to a very different style of thinking, which has been quite helpful to me this year in trading our funny internet tokens. Put simply, he was very good at identifying ideas that would “work” and ones that would not. Instead of saying “oh this company is cheap, or this is expensive, or for this fundamental reason the market is wrong”, he instead was focused on the “metas” and if an individual stock would or would not fit into the meta. And even more simply, he only focused on areas that were deemed “interesting” or was getting emerging interest from the market.

The man focused much more on market interest and momentum than valuations, earnings, etc, because he understood narratives and flows. I could pitch some interesting software or payments company that has some fundamental improvements coming for XYZ reason, and he would say “no that type of idea does not work in this market, let’s re-examine later”. But the same idea in 2019-2022 would have had him drooling. He was truly a Chameleon Investor, and a billionaire for a reason.

Ok, tying it back to crypto. I actually first got into this space in the BSC shitcoin mania of 2021. My best wins came from literally aping every brand new launch on Pancakeswap that had a working website. And then, I changed my stripes and started doing deeper dive analysis on DeFi style projects that had an interesting product and could see a lot of growth from it. But after the short lived Arbitrum season this year, this stuff stopped mattering, and I felt lost. If you’ve followed my content long enough, you have seen me do deeper dive analysis on tokenomics, value capture, etc, and that stuff plainly has not mattered that much this year. I also never focused on being early, and only focused on being right (much more Burry esque).

THE EYE OPENER

It wasn’t until I built chainEDGE that I saw how wrongly I was approaching the current market. You see, once we sat down and ran the PnL for the consistently highest profit wallets in DEX trading, it was an eye opening, environment shifting mindfuck to myself: everything I learned and focused on from 2021-2022 does not work.

Some stats for you:

For background, our chainEDGE data represents ~500-700 of high realized PnL DEX traders ($50k+ realized only, no one hit wonders, no insiders)

This group made $104 million of realized PnL over the last 6 months excluding ETH

74% of these gains came from buying tokens in their first 2 days of trading

The majority of the biggest $ winners are bullshit, no value, no tokenomics meme coins:

PEPE $14mm

RFD $4mm

MRF $2.9m

HarryPotterObamaSonicInu $2.7mm

SHIA $1.7mm

LADYS $1.5mm

FUMO $1.3mm

BEN $1.3mm

SPONGE $1.3mm

HAMS $1.2mm

TURBO $1.2mm

WOJAK $1.1mm

MONG $1mm

BOB $1mm

And so on and so forth

Why is this crazy? I built a tool to track the smartest traders onchain, and it turns out they are making money being early to *mostly* dogshit tokens. Now obviously there are more fundamental winners like UNIBOT, RLB, AXE, COCO, Wagiebot, LBR, but the realized gains were both lower and less frequent.

Now when I first came across this somewhat surprising data this year, I had a decision to make. Wait until the market fits my style of investing, or change my style to match what is making money. I basically had to start from square one after focusing on more established projects for so long, but now after seeing this data, realizing that being not only early, but moving faster is much more important than I originally thought.

Whats The Point?

Now, I’m not saying you should just go full blown memecoin only degen here. Its more about the thought process for your own crypto trading journey. Are you happy with how this year has gone? Are you being too lazy vs. what the current PvP, fast money environment requires? Like seeing all the winners laid out this way made me personally do an internal audit not only on my own trading, but on my philosophy for this space. And the question I asked myself after seeing quite surprising PnL results was the old investing adage “Do you want to make money or do you want to be right?”.

Personally, the complete 180 shift in my trading that came about from building and using my own tool can be summarized as follows:

Being early is actually very important, but you have to be selective

No one cares about the 50th iteration of onchain options, yield aggregating, etc

Any idea purchased has to be either

So early your odds are as close to rigged as possible

The token fits into a ongoing meta, and you are kind of early (still first 2 days)

Or you have a view on an emerging meta

But metas can also die very quickly (RIP bot szn 2023)

Am I rambling? Could be.

Onchain is Dead and Buying Dips

Another secondary shift that I’ve personally developed in my trading after building and using my own smart money tool reminds me of the old Paul Tudor Jones quote: “Losers Average Losers”.

It’s not just crypto, but all markets like chasing a winner or chasing momentum. Buying the top of a token with a lot of emerging interest, momentum and accumulation will probably serve you a lot better than buying the “v2” tokenomics upgrade of some DeFi project that no one really cares about. Now of course the meta for things like the “v2” pump could always come back, but it really hasn’t worked for many tokens this year, and if you see it working, then obviously you can shift your style accordingly.

Another meta that hasn’t worked as well in the past few months is the “seed round” or “presale” strategy, especially for DeFi projects. The market today is just a hot, ever moving ball of money, always ready to chase the next thing, but also ready to dump it if it loses the slightest bit of momentum.

Now, if you hadn’t read this (hopefully) eye opening piece of content, then you might fall into the “man the current market is dead” category. But just the chainEDGE smart money traders in the past 30 days had ~30 different $19k+ realized PnL trades. While the market is definitely getting slower, there are always tokens that catch the market’s collective attention, and print $ for those who are watching.

Like use chainEDGE or not, I think seeing this data should at a minimum should make you question if your current trading setup is optimal, if your 2022 PTSD is holding you back, and what changes you could be making to at least start being profitable again.

chainEDGE Helps

Disclaimer, I’m gonna shill the tool that I’ve spent thousands of hours building. SKIP THIS SECTION TO DODGE THE SHILL. But at least watch the kickass promo video someone from the community made.

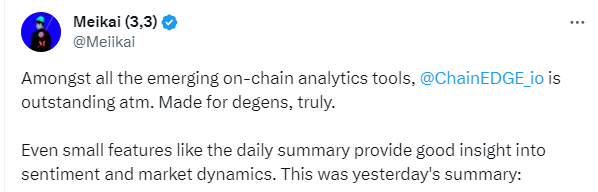

Leave whatever preconceived notions you have about our tool at the door. We have hundreds of active users, who regularly tell us its quite literally “the best”. The combination of adding new features requested by the community weekly, not having a token and focusing on building a best in class product has allowed us to win. We just hit an ATH in users, and its for a reason.

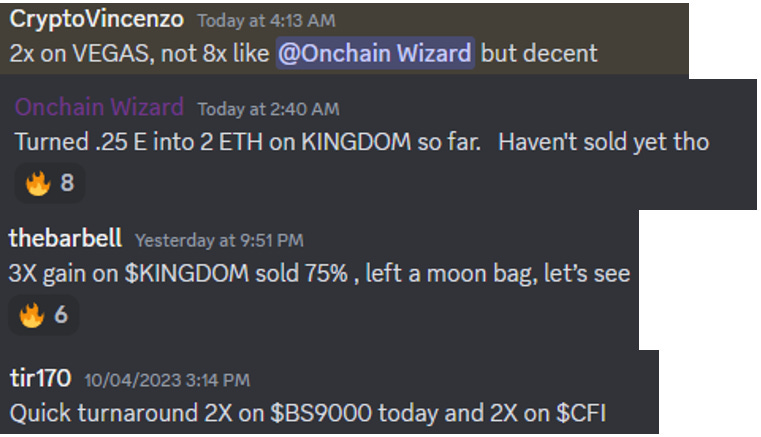

We have a vibrant sub-only discord community, that is working together to make money. Some screenshots of their wins in the past few days:

We keep shipping truly innovative things that are aimed at making you money.

The newly dropped New Launch Digest keeps you up to speed on all new launches worth paying attention too, without being full time in crypto:

While the ever improving alpha stream filters let you customize our smart money data to your strategy (filter by token age, market cap, wallet PnL, wallet hit rate, and even 1 day smart money retention on new launches).

Our Daily Summaries also help keep you up to date on where the market’s attention is flowing:

If you feel like you are missing the mark in today’s market, need a boost to your trading game, or just don’t feel like you have a good feel for what metas are “working”, sign up, join the community and try out our differentiated product.

I also host near weekly live streams where I go over what tokens look interesting using the tool. Our next one is today at 12pm ET.

PS: we do not do trials, but if you do sign up for a monthly and are not satisfied, we’re happy to refund you. The product, reviews and results speak for themselves, and it will only get better in the next month once we launch [REDACTED] and [REDACTED] (CE subs know whats coming).

Closing Time

If you already had this realization, congrats, hopefully you are making money trading today’s market (and I hopefully at least entertained you). If you’ve been left sidelined, stuck in your old ways or have been feeling lost, take this personal “journal entry” of mine to change your colors and improve your game (in whatever way you see fit).

we are chameleon investors using CE tools. Viva OCW.

good stuff