So far, June 2022 has been the worst performing month for Bitcoin since at least 2012, with prices falling ~37% from ~$32k to ~$20k at writing, while ETH has fallen 44%. Are we at peak fear/capitulation? Let’s look through some data to see where we are.

Looking at BTC inflows to exchanges, we can see that in the past week the amount of BTC being sent into exchanges (to be presumably dumped) are at highs not seen since 2018! Smells like capitulation to me.

Source: Cryptoquant

Further, looking at exchange inflows on a CDD basis (which indicates movements by longer term holders), June saw a massive spike in exchange inflows from LT coin holders, suggesting real capitulation / a test in conviction.

Source: Cryptoquant

Looking at historical price moves for BTC (back to 2018) during these capitulation events, it has typically signaled some sort of local bottom. Comparable exchange inflow events were July of 2021 (2021’s bottom), March 2020 (2020’s bottom) and November/December of 2018 (bottom of the last cycle). Obviously, while the current macro environment is different than some of these historical periods, it can be used as a gauge for peak fear for BTC, which then determines price direction for the rest of the crypto ecosystem.

ETH has actually underperformed a lot of alts over the past 60 days, falling 64%. Within DeFi, for example, SNX, MKR, LINK, UNI and 1INCH all performed better than ETH over the past 60D (which is surprising). I think this was driven by a few things, including leverage on ETH positions, that forced ~$235mm of on-chain ETH liquidations over the past month.

Source: Parsec Finance

But also forced selling from 3AC, which sent at least 170k ETH to exchanges (from wallet 0x486) over the past 60 days. This equates to very roughly ~$250mm or so of selling pressure (using loosely blended prices).

Source: 3AC Main Wallet: 0x4862733b5fddfd35f35ea8ccf08f5045e57388b3

While ETH has pierced through the 2018 highs of ~$1,300, there is still $46bn of TVL within ETH DeFi protocols (vs. just 6 figures in late 2018), so we have come a long way in the context of product market fit. Total ETH DeFi TVL is down 70% from the November highs while ETH itself is down 75%.

Source: DefiLlama

On a chain-by-chain basis, here are the TVL changes (from November 2021 - per DefiLlama):

BSC: down 70% from $20bn to $6bn

Tron: down 38% from $6.5bn to $4bn

AVAX: down 80% from $13bn to $2.6bn

SOL: down 82% from $14bn to $2.5bn

Polygon: down 67% from $5bn to $1.7bn

FTM: down 82% from $5.3bn to $973mm

Arbitrum: down just 35% (per L2 Beat) from $3bn to $2bn

Obviously the only bright spot here is Arbitrum, which now boasts a whopping 51% of Layer 2 market share on a TVL basis. NEAR also ~2x’d its TVL, to $290mm (off of a small base).

Source: l2beat

Looking at the NFT market, things are also bleak, with daily trading volumes down 98% from a peak of $1bn in January 2022 to just ~$20mm today (or -90% on a weekly basis).

Source: Dune Analytics

From a NFT exchange market share perspective, LOOKS has fallen to ~20% from highs of ~70% earlier this year (note there is a large unlock coming in July).

Source: Dune Analytics

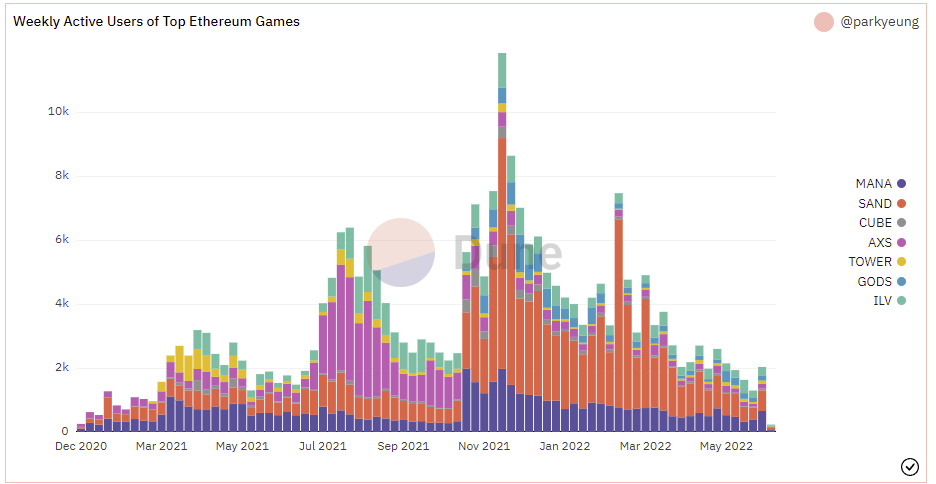

In the Gaming market, the number of ETH game users has fallen from nearly 12k weekly active users in November of 2021 to 2k, with MANA & SAND dominating market share (at least per this Dune Dashboard). AXS users look to have fallen materially (used to be a major market share owner).

Source: Dune Analytics

Looking at DappRadar, DfK users were down 21% in the past 30 days, AXS users were down 37%, while SAND users fell just 3%.

Source: DappRadar

The large gaming tokens have also gotten clobbered the last 60 days, with:

MANA -60%

APE - 70%

AXS -69%

SAND -69%

GMT -75% (which is being banned in Mainland China)

GALA -71%

JEWEL -97%

To summarize thus far, we are seeing some capitulation in BTC & ETH (along with forced selling), TVL is down only across the board, with only Arbitrum showing relative strength (of real size), NFT trading has dried up, while active gaming users has also seen material declines. Is there anything we can get excited about?

While there have been fears of Celsius and 3AC blowups + associated contagion, SBF/Alameda tweeted yesterday that they will “step in to prevent contagion”:

Smart money (per Nansen) has finally started allocating capital again (after seeing stablecoin holdings hit ~peak levels). For context, stablecoin market cap is now ~$155bn or so vs. a total crypto market cap of $892bn (or 17%). That is a lot of dry powder still out there that is waiting on the sidelines to deploy when the environment is deemed to be “safe”.

Source: Nansen

Additionally, while it is hard to quantify the risks of 3AC’s insolvency, at least on-chain, the firm (per known 3AC wallets) does not have much left to dump. Per Dune’s dashboard of 3AC wallets, the firm is holding $277mm of on-chain holdings, but importantly, outside of stablecoins they are only holding major positions in SRM ($41mm), FTT ($23mm), and just $8mm of cETH. Barring any flows from exchange holdings, it appears that the worst could be over from 3AC selling.

Source: Dune Analytics

Other bits of hopium:

ETH active addresses are only down 12% YoY

Arbitrum daily transactions continue to rise (despite broader market stresses), up 90x YoY

ETH & BTC managed to escape large on-chain liquidations from:

$135mm potential liquidation for 0x4093 @ $896 ETH

0x4093fbe60ab50ab79a5bd32fa2adec255372f80e

$225mm+ potential liquidation on Celsius’ wBTC position on Maker (current liq price is $13,604)

https://maker.blockanalitica.com/vaults/WBTC-A/vaults/25977/

Are we out of the woods yet?

Potentially, but I am wary of potential crypto hedge fund outflows in the coming weeks. According to PwC, total crypto hedge fund AUM (not levered), was $4.1bn in 2021. Given the appetite for risk assets has come off substantially given the current macro environment / monetary policy, there is potential for fund redemptions at the end of Q2-22, which could lead to some incremental selling pressure in July. Additionally, with inflation still running hot, a fed pivot may not be coming soon (though there has been dovish commentary lately). The large potential headwinds out there for crypto are monetary policy, Celsius risks, 3AC contagion and on-chain liquidation levels (which I will be monitoring closely).

The total crypto market cap is now within 13% of 2018’s ATH, and we now have games, NFTs and DeFi applications that despite the recent pain, all still have users. The 2 major catalysts for crypto to re-find its “narrative” are (1) the ETH merge which seems to be loosely expected for September, along with any pivot in US Fed policy (which could fall around the same time given weak economic data). I’m not going to make a market call here, but it does seem that we are closer to the bottom now (which is why we are seeing some sidelined smart money begin to bid.

Below are some projects /themes that I am personally researching (and will do paid deep dives over the course of the next few months). If there are other projects or topics you would like me to cover (can be big or small), please reach out and let me know:

XMON/SUDO (already covered, but will update at some point)

GMX

DPX/rDPX

SYN

stETH

UMAMI

CVX

GameFi / Gaming Tokens

NFT Lending

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

First of all, great read and update! Regarding your ask, I would love a deep dive on either PYR, ILV, QNT, AZERO, ROUTE, ORAI, QRDO, ORN/ZCX/WOO (more common names would be NEAR, RUNE, METIS, ROSE, ATOM), or L1 dark horses TARA / GTH. I decided to just list a lot of the projects I find interesting, and of course understand you will pick the one(s) you find most interesting for an actual deep-dive ;).

Thanks for the update. Lots of good analysis that provides great clarity during this correction.