Changing up the schedule here (whale watching will be on Friday), we’re going to dive into LSDfi in 2 parts: In this issue (part 1), we will cover a high level overview of what LSDfi is, which projects are gaining traction, etc. Part 2 will be a paid version of upcoming launches within this narrative (the hottest narrative of the summer), including the opportunity to participate in a private sale for one of the tokens.

What is LSDfi?

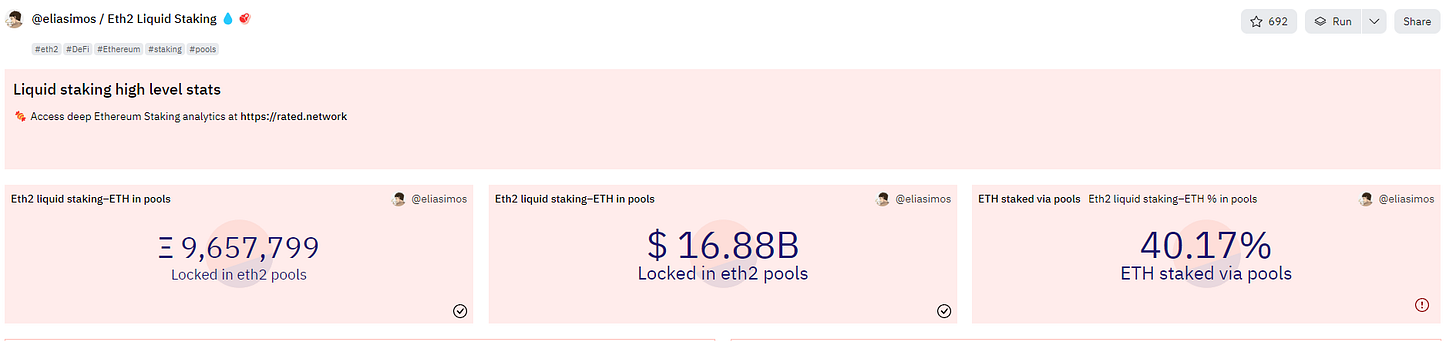

If you are not familiar, LSD stands for liquid staking derivative, which is just the liquid forms of staked eth. The most popular are stETH and wstETH from Lido. This narrative is picking up attention because the amount of ETH staked is almost $17bn, and this large amount of capital will look to find the best way to increase the yield on their staked deposits.

The simple way to understand LSDfi is to think about it in “layers”. The base layer here is the established staked eth players like LDO, RPL and FXS.

And then the new emerging “layer” builds on top of the base layer, and is made up of newer protocols like Lybra, Pendle, Raft, Unsheth and Flashstake. This year, the TVL of emerging LSDfi building blocks has risen to over $400mm (suggesting a lot of room to run vs. the $17bn of total staked ETH).

New project Lybra (token LBR) has led the way, growing its TVL to over $160mm.

The below graphic helps to break down each of the new building blocks into their respective categories. Pendle and Flashtake specialize in allowing LSD holders to trade their yields. Agility, Lybra and Raft are lending protocols that allow users to borrow against their LSD collateral and mint stablecoins against it. LSDx, Unsheth, Asymmetry and Index offer the ability to diversify a users yield across all the different LSDs to help users optimize things like yield.

Of the leading new LSDfi projects, LBR, USH and Pendle have tokens already, which have performed very well as a part of this narrative heating up. LBR is the smart money favorite thus far, generating ~$550k of net swap inflows over the past month.

The market caps of even the leading “layer 2s” of LSDfi are still very cheap, with LBR trading at only a $6mm market cap currently and USH at a $7mm market cap, so if TVL continues to pick up momentum, look for these leaders to grow into more meaningful valuations.

Keeping it Real:

I do think its important to realize that these are not “new” innovations going on, and are really just plugging a new asset class into Defi products. While this narrative has some steam (and crypto markets love narratives), I think some of these products that will launch over the coming months will not be sustainable long term, so keep an eye on TVL growth within the category to see who is gaining actual traction vs. who is not (and keep an eye on tokenomics). Personally, I am looking to build positions in the current winners (LBR and USH), and trying to position myself to get into upcoming launches (as either short term flips or medium term holds). With over 40 LSDfi projects now launched or launching, this space is going to get crowded and the winners will be very clear in terms of TVL. Additionally, the more sophisticated onchain PVP traders are likely getting into early token rounds on all these upcoming LSDfi launches, so please exercise some caution on aping, especially with the overall appetite for alts being at one of its weakest spots this year.

In Closing:

Trying to keep this short, as most of you have probably read about this narrative already, and it’s use cases are not complicated. In the next post coming out later today, I will do deeper dives into a few upcoming LSDfi launches, including a sub $1mm market cap private sale opportunity for one of the projects in question. As always, drop any comments, questions or whatever below.

Keep up the good work chief 🫡

I already invested in LBR and USH. I also follow them on Arkham and Defilama. Once I saw your view on LSD. I knew it was a right move lol. Thank bro keep up the good work. Can’t wait until part 2