Making It All Back

Some Market Updates and Degen Ideas (DYOR)

Obviously it has been a crazy week, with FTX blowing up, and the ensuing contagion still going on. ETH fell ~23% while BTC fell 20% over the past week or so. This came at the same time equities surged on the back of last week’s weaker than expected inflation report. So how do we make it all back? I’ll examine some high level market data / commentary to begin this post (for everyone) and then will dive into some more degen trades / frameworks in the 2nd half of the post (for paid subs).

First, I think its important to be very careful with the idea of making any lost gains (or funds that were lost in FTX/BlockFi) in one trade, as you will likely be using a lot of leverage, and will end up getting liquidated. Also we don’t know how far reaching the contagion from FTX’s fallout will be. With that said, here are some thoughts on why we may be “near” the bottom → please note that no one will be able to call the market bottom with perfect precision, and these are just my thoughts.

Contagion:

So far, the only major “contagion” announcements have been people that have had FTX exposure. Its important to remember that what matters is forced selling of assets and when, which will drive prices down. I wrote about this here back in July, which was near the last bottom. We have seen the likes of BlockFi, Genesis and some crypto funds that had $ on FTX. But, most of the contagion thus far is money that literally “disappeared” into the FTX black hole. Users will not be able to get much of this back, and it likely won’t be for some time. Said another way, no near term forced selling there. While there are concerns about centralized exchanges going down, it has only been really small players going belly up thus far. While there are risks that another major exchange goes down, the hope is that the combination of (1) massive outflows from exchanges and (2) less leverage at these companies can mitigate any “forced selling” for the major crypto assets. We still don’t know the full picture, and if another major event like a large exchange going down or a material tether de-peg comes to fruition, things can obviously get much worse. But with that said, and from what we know, the forced selling picture does not really seem as bad today as it did in May/June with 3AC and others having to sell down everything they had. I’ll say it again: this can change, and I’m not calling a bottom, but some people are starting to look past the FTX event. Given broader risk assets are catching a bid (NASDAQ up nearly 8% over the last week) on improved inflation data and what sounds like lower Fed interest rate hikes going forward, we could be near a bottom. Let’s look at some other data to build the case of being near the bottom (or that people are just too bearish right now).

(1) Nansen smart money holders have started allocating stables again, after capitulating on 11/8. This has been a reliable indicator for trading market direction, so I find it interesting that some risk appetite has come back so fast. Basically the same % of stables has been allocated in the past few days (going from 39% of holdings to 32%) as smart money traders allocated in the first week of July (which marked the bottom for ETH back then).

(2) I looked at historical trader positioning on GMX to see if there were any bottom indicators (and there were). Basically any time people get aggressively short for a multi day period on the exchange, it has signaled that sentiment is too bearish this year. We are currently in this year’s 4th instance of this level of positioning, which if past data from GMX is a predictor, means we may be near the bottom (GMX open interest may be too low to be a great predictor from a data perspective, but so far this year has rang true). ETH has moved at least 20% higher on each case of people being extremely net bearish for multiple days this year, usually with the market punishing them in short order.

GMX positioning is at its most bearish for the entire year, so if contagion risks are less than people think and sentiment is too bearish, just at the time when risk assets are getting a bid again, you can make the case that we may go higher short term.

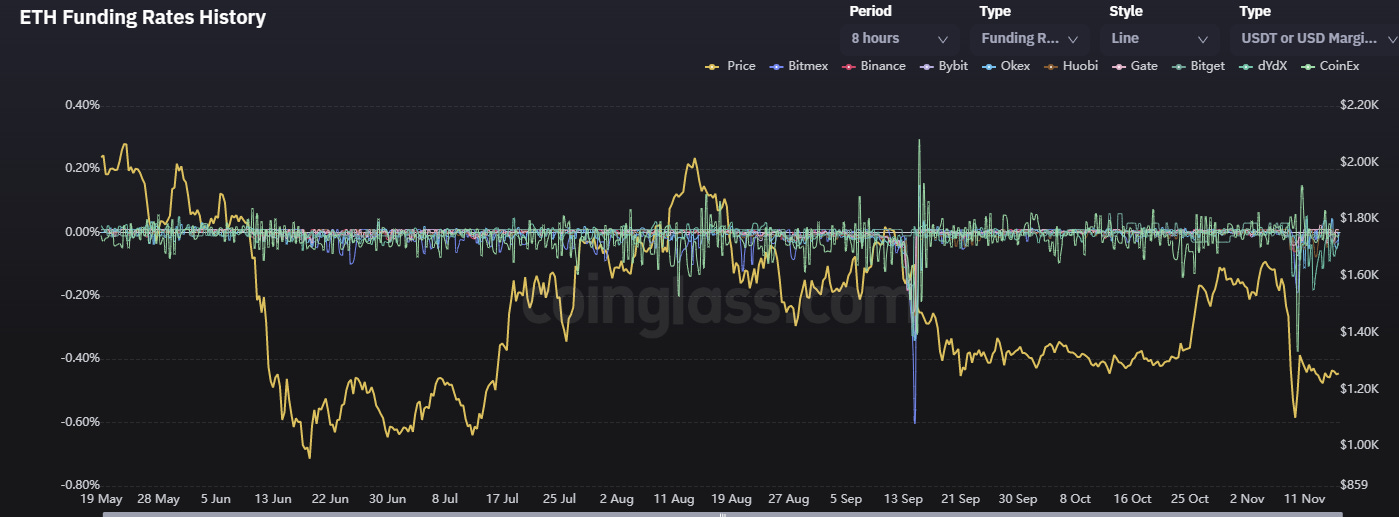

ETH funding rates are also still negative, but have retreated from the hyper bearishness from just a few days ago.

(3) There are no onchain liquidation levels anywhere close to current ETH trading. ETH would have to fall to $800 to hit just $50mm in liquidations, with more meaningful liquidations at the ~$650 level ($400mm). Back in June, the market was hunting any large liquidation levels, so unless we really start to have some issues, it looks like there isn’t much forced selling from a onchain debt point of view.

Looking at liquidation levels for ETH across all exchange leverage per Kingfisher, it looks like we still have some clearing of leverage to do (down to ~$1k or so). Who knows if we get those levels, but also seems like there are short liquidations to be hunted around the $1,500 level. I would note that the strength of ETH throughout this whole episode has been telling.

Exchanges have seen over $6bn of outflows in the past week (but some have already started getting some inflows in the last 24hrs). Unless these firms were running with significant leverage or were investing customer funds (like FTX) there doesn’t seem like a lot of forced selling candidates from this list (yet).

Even GCR, one of the best crypto traders out there, has been vocal about the idea of making it all back trying to short things to zero. He was also recently scaling out of some shorts (like DOGE).

Even the FTX Hacker is bullish on ETH (lol). They are now the 35th largest holder (their wallet is worth watching in case they do liquidate this massive position).

High level:

It is going to take a long time to see how everything shakes out and if there is any hidden levered players waiting to blow up + be forced to sell. With the recent increase in onchain activity, ETH has turned deflationary, and will become a narrative again.

If you have funds on some Tier 3 exchange, it is still probably worth getting them into a higher quality CEX or just custody the assets yourself. Smart traders are bidding again, liquidation levels do not seem to be a concern, risk assets are catching a bid and trader positioning (especially on GMX) is likely overly bearish. This FTX situation had nothing to do with crypto, and everything to do with bad actors, incompetence, leverage and deception. This space is going nowhere, with major institutions still moving forward with plans for the space.

Degen Trades:

Ok, now to the paid section of the post, highlighting some token ideas for you, but also some (still) fertile hunting grounds. Please note that we are launching the public beta of chainEDGE in the next 2 weeks, so you can also leverage this to follow cross chain smart money trader movements into higher upside (risk) tokens.