Onchain Wizard Issue #2 - Intro to Whale Watching

Onchain Wizard Issue #2 - Intro to Whale Watching

Wallet watching has been the number 1 requested topic for me to cover, so we will be diving into it for this issue. Whale watching has been the single largest contributor to my success in crypto. I went from buying SUSHI because everyone on CT thought it was cheap, to building my own investment portfolio where I was finding great ideas from other wallets, which I then exited when things were overheated or the hype cycle was over.

What is whale or wallet watching?

To do this effectively, you will need to use a combination of etherscan (and the similar free scanners for AVAX, FTM, Arbitrum, etc), Debank, Nansen (a 7 day trial is $9) and something like Dexscreener or dextools. You are effectively trying to find "smart money" wallets that have better information than you or are just better traders. But it is important to note that you shouldn't be blindly just copy trading these wallets. Why? Because if you are following a longer term (3 months+) investor, if you have no conviction in the project that you followed them into it, you will be much more likely to bail when your investment falls 30%+, and likely sell the bottom. Whale watching is good for finding projects, seeing overlap among whales/smart money, and understanding their conviction. Also for the purposes of this issue, I will be focusing on smaller cap projects, where the risk/reward is far greater than buying mega caps like DOGE or AXS.

How do I get started?

First things first, I want to highlight that crypto is a highly volatile, 24/7 market. No one actually knows what the price of anything is going to do, so this is not a guaranteed path to success, but rather gives you the tools to know where to look, how to size your investment, etc.

There are 3 ways to go about finding wallets (outside of looking at top holders, which we'll do in another issue):

Nansen "smart money" or "token god" modules

Finding large, early investors to a very successful project

Using wallets that you can find from others (an example will wallets I will be sharing in my paid discord research hub group further down the line)

Nansen

If you have the budget to at least get a trial ($9), you can use Nansen to either screen for "smart money" moves on DEXs or find wallets to watch based on "notable wallets" on a token you like. Be careful looking through these and always confirm that the subject whale actually bought the token, and was not "gifted" it from a scammer trying to get people to buy their rugpull token.

Nansen Example #1:

Using their module "smart money", you can see which alts are seeing inbound capital flows from smart money on DEXs on ETH. For this exercise you are trying to find tokens, rather than wallets, thought it doesn't yield any amazing results based on the last day of volume.

The first pair here (contract address starting with 0x9dd) is a token called Richard Millie Metaverse. DO NOT TOUCH THIS. This is an example of a token scam, where the contract creator and liquidity provider are running a "honeypot" where you can't sell. How can you tell? There are consistent, robotic buys on it every 10 minutes (look at dexscreener), and somehow all of these notable wallets bought this at the same exact time (see below from Nansen), which does not actually happen. Scammers know the power of whale watching and are trying to manipulate it to steal your money (which lines up with my first email issue on this space). Looking through most of these alts, the only ones that aren't straight up scams are ALI (which looked to be just people front running a crypto.com listing) and FXS (which people are chasing on the new FRAX UST 4pool). I don't think this yields any interesting ideas for us at this point, but its useful to watch during the week as there are less scams being traded (volume is light on weekends).

Nansen Example #2:

Nansen has a smart money dashboard of changes in token holdings (see below). I filtered this based on 7 day $ amount changes in tokens. There are some actually interesting ones in here (FXS showing up again, COW, MPL). Given you are seeing smart money move in these tokens, it can be a good sign that they are worth researching. I'll do my next issue on how to research a protocol, but high level you want to understand (1) what the project does or is trying to solve, (2) are there any near term catalysts on why the price should go up and (3) how high is the relative valuation vs similar projects, and how much upside could there be and what are the risks.

But this issue is about finding wallets, so lets keep going. So we saw "smart" money move into MPL, which does undercollateralized loans primarily for institutions. We can go to MPL within Nansen and look at "Notable Wallets" to see if there are some good whales to add to our list. Remember, you should be playing the long game here, and build a massive list of wallets over time. Once you get a hang of what you're doing, you will actually be able to "rank" your own wallet list based on how each wallet's investments have panned out (you can watch their track record given all the activity is on chain).

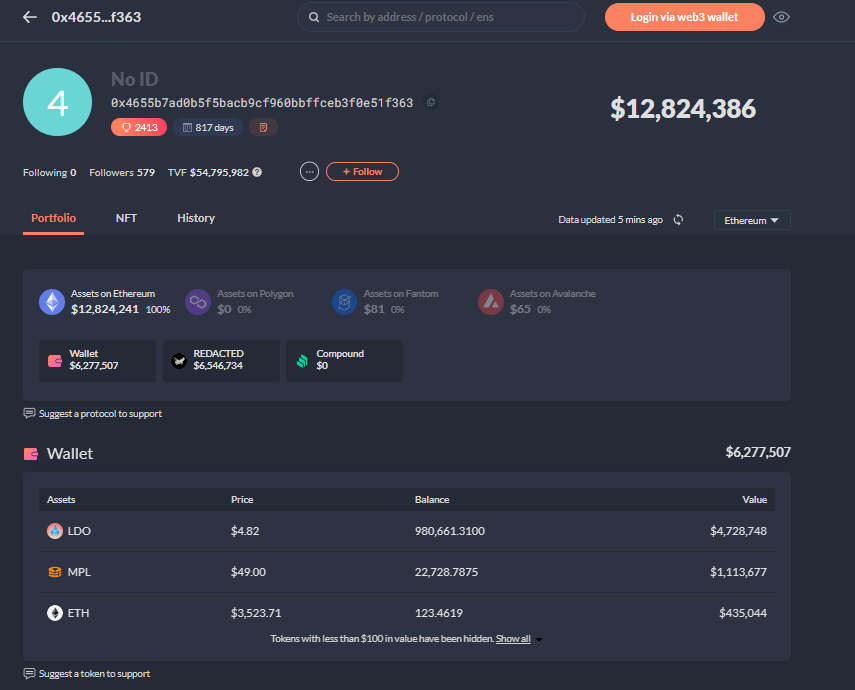

Looking through the top 30 day token moves here, there are a bunch of wallets we could dig into, but lets focus on a fund wallet here, which is ParaFi. You can click on their address in nansen (save it in your watchlist of wallets), and then paste the address into debank to get a better look at their portfolio and trades. Looking at their portfolio on debank, you can see that some on chain folks already follow them (579), and they are running a ~$13mm onchain portfolio, of which only $1mm is MPL.

Why is that important and what can we learn? Well we can now watch this wallet on future buys and sells obviously, but with our own conviction. We can use the history tab on debank to look through historical buys and sells, and add it to your watchlist on debank so you can get a feed of any future onchain activity. We can make a track record assessment here as well, along with portfolio sizing perspectives. They bought $800k of MPL, which is now worth ~$1.1mm, which is obviously a decent trade given they bought on 3/21. So we know that this does seem to be "smart" money, with likely better information that ourselves.

Additionally, given the allocation was a small percentage of their onchain portfolio (~6-7%), they may not view it as a higher conviction or higher upside trade vs. something like BTRFLY, which is basically half of their portfolio. There were obviously a bunch of wallets in the smart money moves, so you can comb through each one and decide to add to your own whale watching list based on if their portfolio is of a large size, are they worth tracking (track record decent on historical trades) and historical activity (more active wallets give you more information). A few other things to note here. First, when you look at a wallet's debank like this, all of these tokens that they "receive" are scams so ignore them. If you don't see a contract interaction from the actual wallet holder, it means they did not buy it and it needs to be ignored. Additionally, there are potentially more wallets to be found just from this wallet. Looking below, you can see they sent $500k to another address. Within debank, you can click through and follow this money to see where it goes. In this case, you will follow it from their ParaFI address to 0x9121, and then from there sent to 0x7166. Sadly this is a dead end, as this is a known coinbase wallet (you can google the wallet or run it through nansen to see if its an exchange or not). But sometimes tracking historical flows like this will lead you to other gem wallets (like Tetranode's second wallet for example), that can give you an edge vs others.

"Early Winners"

This method is a little more time consuming, but can be even more helpful than using nansen. Because these wallets are not as "accessible" there can be more alpha found from them. You can do this a number of ways: you can filter a token through dexscreener or dextools, filtering by $ buy size very early on in a project. Or you can go direct to the blockchain explorer sites, and find large buys very early on. These wallets are telling you that they either know how to spot a gem early, or have better information than you about an upcoming launch, etc. Sometimes these wallets can be "one hit wonders" meaning they were only early to one homerun investment, but miss others. Other times they end up being early to other projects as well, helping you return multiple Xs, which is needed to grow your portfolio from a small base to a much larger one.

Early Winners Example #1

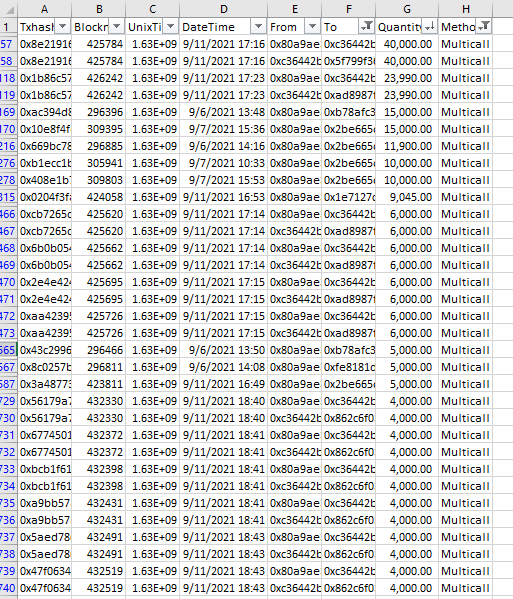

Let's take one of my favorite projects, GMX as an example. GMX started trading on September 6th, 2021 on arbitrum, back before there was much activity on the chain. The price quickly went from ~$3 to $40 within 2 months, and has maintained its value by growing fees, users, etc completely organically. But to find wallets that really crushed it on GMX, we need to look at big, early buyers.

To do so, we head over to arbiscan, and download all of the transaction activity around the launch. We filter for high GMX token swaps or multicalls around launch time, and then we can dig through these wallets to see who crushed it and still runs a portfolio of size today.

Looking through this list, we can find a degen that crushed this trade, address 0x1e7127c81c8a58661a0811f026b6be66533934be. They had multiple buys of $50-100k that turned into much more. This a good wallet to follow because they are very active, and invest in a lot of things, which could be good projects to research.

Looking at recent transaction history, this degen even bought $40k of STG which is now $215k. This is a great wallet to follow obviously. Having a comprehensive wallet list of investors like this vastly improves your chances of success on chain, as you will be getting constant information of projects to research, new launches to ape into, etc. Truly playing the game at a higher level vs. buying a reflector token from a CT shill.

"Wizard's Wallets"

Sometimes you can find wallets just from hanging around in discords of certain projects. One of the most highly followed wallets, is of course Tetranode: https://debank.com/profile/0x9c5083dd4838e120dbeac44c052179692aa5dac5.

If you are not familiar with this orca, I would suggest listening to his various podcast episodes. He was an early investor in BTC, then ETH, and is now focused on dominating DeFi. This is one of the wallets I watch closely, especially on his DPX positions (given I own some tokens in that ecosystem). Now that I have his wallet, I can follow his incentives of each project, see where he stands to make the most, projects that he invested a very small amount, and can see when he sells. Also, given Tetra is an advisor to most of his holdings (outside of ETH), you know that he probably has a better line of sight into value creation for the token than you do.

I tend to focus on investor/operator wallets, but my guy on twitter @DeFi_educator is also an on chain sleuth that has youtube influencer wallets, which can signal when a paid shill is potentially coming up, or there could be other catalysts at play. In one of his upcoming newsletters, he'll be dropping a few wallets he watches, so give him a follow if you'd like to add this wallet type to your arsenal (he's also just a great follow to be begin with).

Putting it all together.

Going back to my first issue, you cannot take this information in a vacuum. You have to build your own conviction in these investments, know where you are in their token price journey, and know where you are in the "hype cycle" of a token. Whale watching is a good tool because you are now more educated than the traditional crypto user that is buying ADA, DOGE, etc based on price targets from a youtube influencer, and instead you are building your own process of how to make money. Watching these wallets can give you token ideas, farming ideas, and give you signals of when you are early (maybe only 1 whale is in, more whales are accumulating) or late (its being shilled on CT, but whales/insiders are dumping). Over time, there is an art to wallet watching, as you start piecing together wallets that seem to move in tandem, wallets that front run coinbase listings, etc. If you do end up blindly copy trading these wallets, your expected portfolio return is still probably better than following CT shills.

If this Intro to Whale Watching was of value to you, please kindly retweet to spread awareness. I'll be doing future deep dives on whale watching, token research, narratives I like, etc,

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Nicely done ser. Teaching a person to fish!

You shared such a good starting point that I want to share too. So here's a list of wallets that I "cursory" follow. I need to systematize the process like you did.

3ac_1: 0x82ac5170a837f6554d518c71c0590723437e6b64

3ac nft fund_1: 0x2e675eeae4747c248bfddbafaa3a8a2fdddaa44b

tetranode_1: 0x9c5083dd4838e120dbeac44c052179692aa5dac5

tetranode_2: 0xa22eb3338dfd69458513a1f6d4742ab29f7ef333

alameda_1: 0xc5ed2333f8a2c351fca35e5ebadb2a82f5d254c3

mark cuban_1: 0x293ed38530005620e4b28600f196a97e1125daac

machi (cream founder) nft: 0x020ca66c30bec2c4fe3861a94e4db4a498a35872

justin sun_1: 0xc21087f0b51bb074fb7e060cde64b125c88b0865

dom.eth (creator of Loot + Blitmap + Vine): 0xf296178d553c8ec21a2fbd2c5dda8ca9ac905a00

Defiance: 0x9b5ea8c719e29a5bd0959faf79c9e5c8206d0499

andrew kang: 0x16C67A048da06f554F9cE5cd49212677638Fa845

crypto cobain/ cobie (?): 0xB0Cf943Cf94E7B6A2657D15af41c5E06c2BFEA3D

Thank you for this great content!