Token Unlock Frameworks

Ways to Analyze Token Unlocks

Bullish unlock? Or a massive amount of sell pressure coming to a token near you. Let’s examine some ways you can do a deeper dive analysis into how much pain is coming to a token with an upcoming unlock. Also reminder that later today the monthly whale watching post will be out, which now will include smart money movements from chainEDGE, so you can see what smart money is doing on chains like Arbitrum.

How to Find Upcoming Unlocks:

The best two ways to find the majority of unlock data would be either from Unlocks Calendar or by using Token Unlocks. If you have specific token in mind, and the unlock data you are looking for isn’t available from these resources, you can also go straight to the project’s tokenomics documentation, and calculate when major unlocks are coming. Its important to note that unlocks should really be a concern when the circulating supply is much smaller than the fully diluted value (and the amount unlocking is significant).

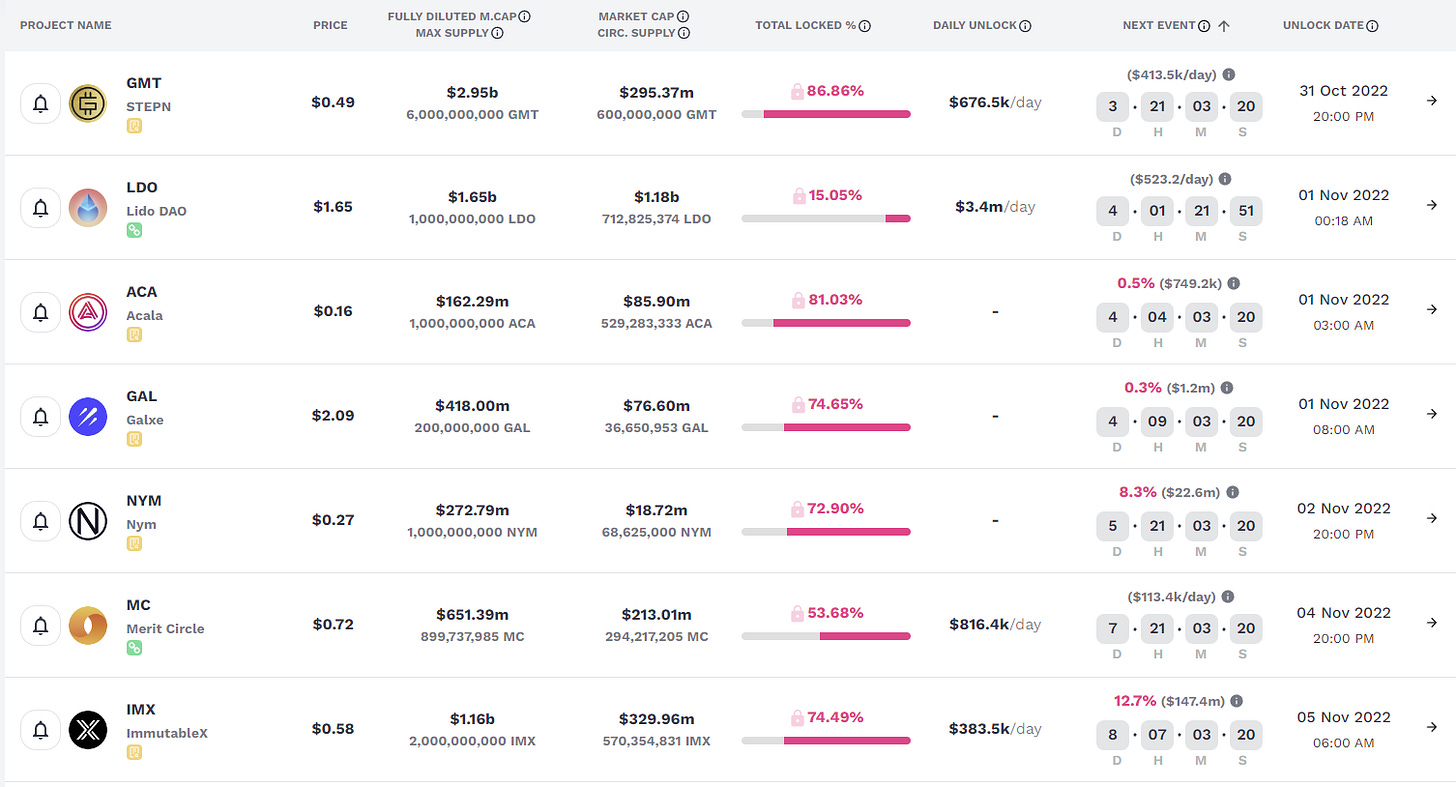

Looking at recent data from Token Unlocks, you can see that there are two upcoming nasty unlocks worth investigating, NYM and IMX, with 8-12% of the circulating market cap unlocking.

But some unlocks hit differently than others, so it is important to do your own deeper work to see how much of an impact the unlock could have on the token. For example, LOOKS had an unlock I flagged back in June that happened mid-July and the token proceeded to increase over the next month. YGG, on the other hand, had a unlock flagged back in September driving the token to fall 28% since and 42% vs. ETH. AXS is another example of one I flagged in September that fell 26% over the past 30 days vs. a 14% rise in ETH. So how do we research these things?

Researching Unlocks:

First, I think its good to start from a position of severity → What would cause the price to be severely negatively impacted? So first, you are looking for what percentage of the supply is coming to market (which is typically easy to find for most major tokens). And then its worth comparing this to how much the token trades on CEXs, or how much liquidity it has on DEXs. But usually people stop there. Given I’ve seen examples where a big unlock into small liquidity doesn’t crush a token (like ALICE), we need to go deeper to find our edge.

The first step to a true unlock analysis starts with who is unlocking. For example, looking at IMX’s upcoming unlock, its current circulating supply is ~235mm tokens. On 11/5 ~259mm tokens will unlock (more than the entire current circulating supply).

120mm of the unlock will come from private sale investors. While I haven’t found great data to confirm what price they got in at, I have seen numbers speculated anywhere from $0.025 to $0.1. This is the first major unlock for these investors, who are up ~6-20x on their investment, and likely are very motivated to sell. We are dealing with pretty big numbers here as well: ~$68mm of private sale tokens will unlock in November. While the project has contended these are longer term holders who will not sell, who is going to leave $68mm of chips on the table on a $1bn+ FDV project in this macro and financial environment?

The remainder of the unlock comes from “Project Development” tokens, which will be relocked, so no sell pressure will come from there.

Another good next step, once you have found out how much of the unlock is motivated to sell, is to look at how much liquidity the token’s market has. So for IMX, the volume is pretty weak (less than $3m on most CEXs), so when compared to $68mm of potential sales, should not bode well for the token’s price.

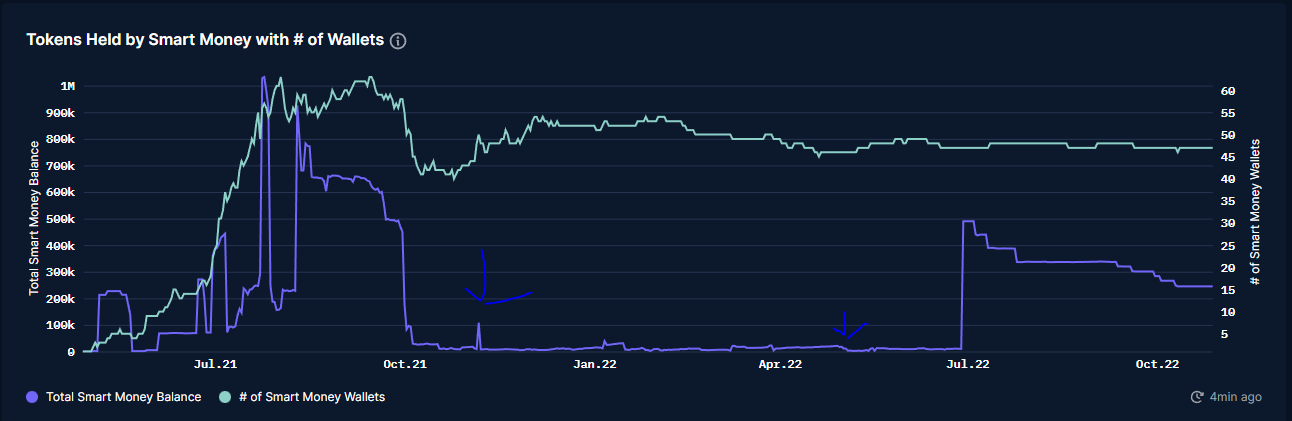

An additional angle is to look out what the smart money is doing, to see if they are fading the unlock, or if there are upcoming catalysts you could be missing. In IMX’s case, smart money balances have been down only for nearly the entire year:

You can also use smart money balances on tokens with historical unlocks to get a rough sense of if they are long term holders or if they like to dump, given a there should be some smart funds that were early on as public and private sale investors. On AXS for example, there were spikes that were immediately sold or transferred out as they came in.

You can take this a step further, and monitor historical unlock behavior at the holder level. Basically you want to comb through a tokens contracts to find where they unlock, who receives them, and the holders behavior thereafter. Let’s use an example. Say you want to analyze the AXS unlock. If you go through AXS’ labeled accounts you can find the token vesting contract where the unlock tokens are transferred from.

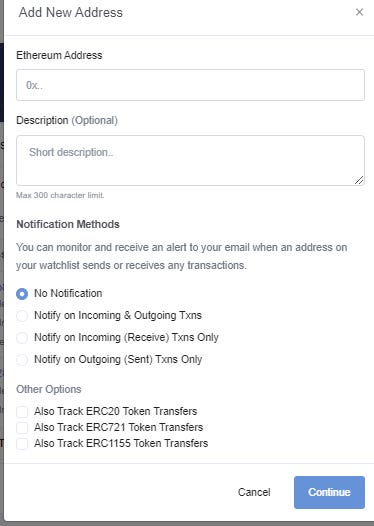

From there, you can peer through large recipients of AXS, and monitor their behavior. I also like to set up temporary etherscan alerts on this contract to see when the unlocking actually begins (which is super easy to do). You need to create an etherscan account, and then go to “watch list” and add an address you want to be notified on.

Peering through the claim transactions, we can see Arca - 0xe05A884D4653289916D54Ce6aE0967707c519879 - received 437k AXS as part of the unlock, which was immediately sent to FTX (to likely sell). If you look at Arca’s historical behavior around unlocks, this is a pattern. Using wallet profiler for token, you can see the tokens received around prior airdrops are sent out or sold.

If you want to really go deep on your analysis, you could build a mosaic of these movements for all unlockers to get a real sense of how much sell pressure is coming to a token. Just look at the addresses and run through this process on the major ones to get a sense of their historical behavior, and you can monitor them real time to see if they are dumping.

Putting it All Together:

If you are familiar with researching unlocks, none of this will be news to you, but I haven’t seen someone put together all the tools to research it before, so thought it was worth sharing. While I can’t recommend shorting these unlocks, if you are looking to do so, you should pair this unlock analysis framework with my How to Research a Project framework to find something with deteriorating metrics and an upcoming unlock that is significant vs. trading liquidity, with motivated sellers with a history of dumping. As always, drop any questions below and happy hunting.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

What happened to the monthly whale watching post that was suppose to be out later that day?