Below is how I am positioning into 2023 for your viewing pleasure. These are summary theses, and I will be doing deep dives on these ideas over the next few months to add more context behind my thinking. Please note that most of these are higher risk, and could very well go to zero, so do your own research and none of these are reccomendations. I also hold and will buy the tokens mentioned below, so I am obviously biased. Final note: paid subs will be getting another whale watching issue on Monday.

Long ETH / Short BTC - This one is definitely not contrarian, but I think it still works. The supply side structure of ETH has significantly improved since the merge, while BTC has to fight (1) large amounts of selling pressure from miners, (2) Mt Gox selling pressure and (3) any GBTC noise. ETH/BTC has traded flat for 5 months straight now, and I think as the macro/fiscal environment gets better by 2H-23, ETH may take its shot at flippening BTC

BONE - I think the launch of SHIB’s Shibarium chain in 1H-23 will come with a lot of attention from DOGE/SHIB other doggy meme token holders, and a small degen season likely pops up on the chain. Smart money continues to accumulate the token ahead of its launch, and at a ~$195mm FDV, could be a pretty good risk/reward compared to other chains if there is actual activity on the new blockchain. BONE related tweets still get tons of engagement, so I think there is retail appetite for it despite the “crypto winter”. So assuming the majors have a “better” year next year, I think BONE is a interesting higher beta way to express a bid for risk assets

RDPX - I covered some of my thesis here, but now we have some of the most concrete updates in terms of timing. Its v2 upgrade, the major catalyst for the token, will go into testnet and be audited in early February, with a full launch soon after. Smart money has been allocating to the token, and the community remains one of the strongest I’ev seen through the bear. At a ~$43m market cap, I think the combo of a successful v2 launch + improving financial conditions + other product releases on Dopex’s roadmap, the token has upside to at least $100 sometime next year (and much higher if we get an “Echo Bubble”). Token emissions have been turned off for months as well, so the supply side structure is pretty solid.

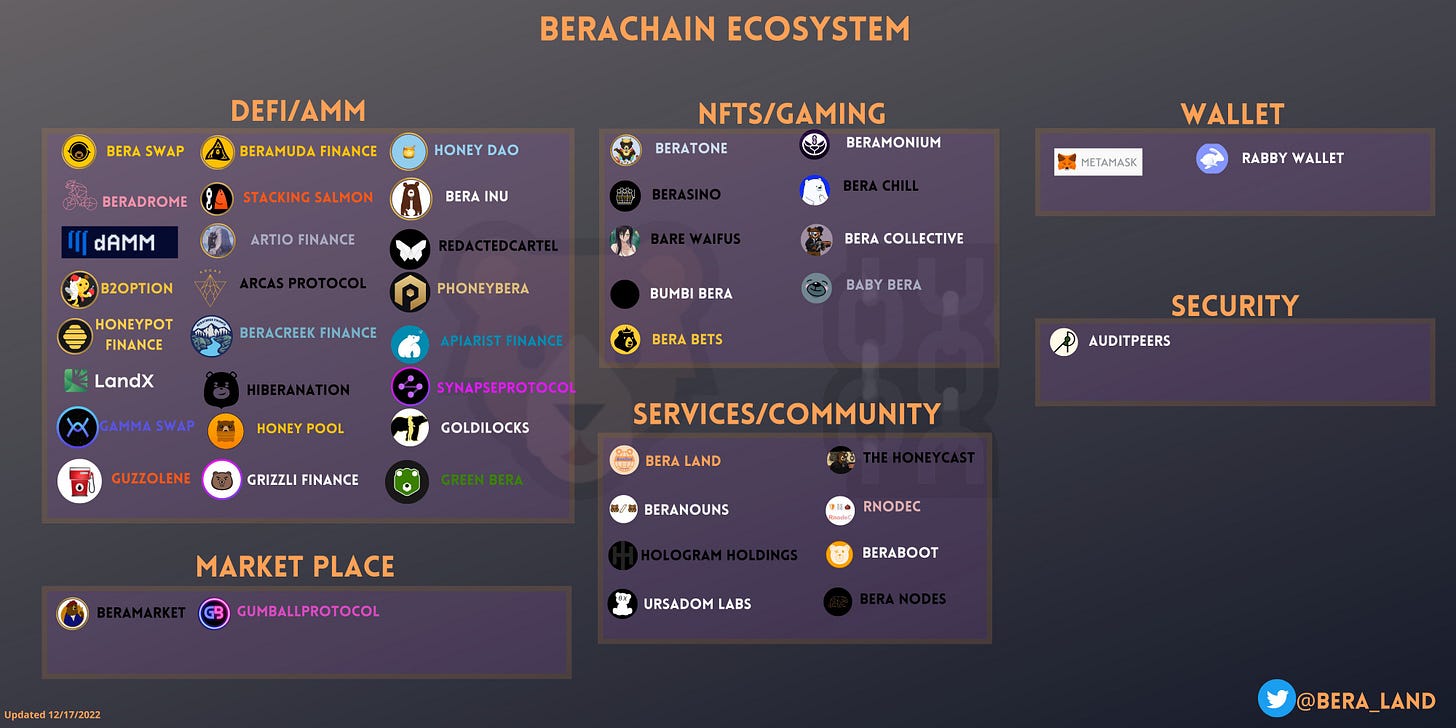

Anything Berachain - I covered Berachain here and talked about why I think the structure + community make it much more interesting than other new chain launches. With all the projects building on the chain, there will be a bunch of opportunities in smaller cap tokens as well, once the chain launches sometime next year. Or you can try to position for the airdorp via NFTs / honeylist, or buy the token in its public sale as well.

Long GMX/GNS, short DYDX - Another pair trade. GNS and GMX are so far the only clear market share threats and gainers from DYDX. At the same time, DYDX has a nasty token unlock schedule over 2023, which kicks off in February. As more people trade onchain post-FTX, this is my way of expressing a long view on growing DEX perp adoption, while heding downside risk, with a kicker of brutal unlocks throughout the year.

UNIDX / Perp DEX Aggregators (warning, degen) - Every new project is launching a perp DEX, and at some point, a killer app will be a place that aggregates all of these into 1 place. Traders would pay higher fees for the convenience of being able to put levered trades on from just 1 source (I know I would), and my understanding is that Unidex is building this. This is a theme I am hyper bullish on, so if there are other projects looking to solve this, feel free to flag them in the comments, as this is more theme driven, instead of specific token driven.

Factor Dao / FCTR (also degen) - I am bullish on all things Arbitrum, but really am not interested in another GMX fork, something that aggregates GMX yield or does delta neutral GMX vaults (competitive positions can erode in all of these fairly easily). Given Arbitrum is already a hub of DeFi projects, I think this project could fill a void in the untapped asset management vertical. It sounds like their mainnet launch will be in Q1-23, and I expect big things from this project (I also can’t wait to use it).

Shorts: I think next year will be more of a “token picker’s market” where vaporware products with crappier emissions & unlock schedules will see their tokens bleed out over the year while stronger, better positioned projects can actually do well. To round out my top picks portfolio, I am looking at shorting some of the more eggregious tokens to protect downside (especially on my more degen ideas). These include

STEPN/GMT ($1.5bn FDV / $154mm market cap)

IMX ($808mm FDV / $296mm market cap)

APE ($3.5bn FDV / $1.2bn market cap)

There will obviously be better ideas over the year that what I’ve laid out there, but these are at least my highest conviction, higher upside ideas and how I would think about constructing a portfolio for 2023 (not a reccomendation). As always, feel free to drop any comments, questions, whatever in the comments.

Lastly, I’ve been toying with the idea of putting together a daily newsletter with more real time news, announcements, research to check out, etc. This would be quite the changeup from the current ~weekly posts, so I wanted to gauge your interest in if you would want to read a free daily newsletter / if you even like daily newsletters. If you’ve made it this far, it would be appreciated if you could just drop an answer into the poll below. Also FYI - If we move forward with this, I would likely take it off of substack to make the formatting more engaging. If you have suggestions of what would be the most helpful to you personally to have on a daily newsletter, feel free to drop that into the comments or let me know as well.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

I'd say keep weekly as is, well curated, high signal content and if you'd like to venture into daily schedule - definitely separate it, I'd say telegram channel/discord group would be more suitable for that - esp. that it'd let community interact as well.

There's already tonnes of daily update newsletters / TG channels out there. Would prefer longer form / deep dives from OCW! Informational updates are a dime a dozen but opinionated insights are not.